Have you ever been to the DMV, only to be turned away because you didn’t have the countless forms of identification needed? Sometimes it feels like no amount of ID or proof of residence is enough, whether it’s your 2nd grade report card or an electric bill from 25 years ago.

That feeling is what it’s like for anyone working in compliance; regardless of industry. Banks are no different. They need to possess compliance documents such as Consolidated Reports of Condition and Income and other Federal Financial Institutions Examination Council (FFIEC) reports that work like the laundry list of documents you need to get a driver’s license or get your car registered.

The same can be said for newly licensed and legal cannabis companies. They often need state and local inspection documents, federal background checks and a list of other documents that make a CVS receipt look minuscule in comparison.

Historically, across all industries, the whole process of gathering and providing these sorts of documents can turn into a bit of a charade. Many companies do the bare minimum to check the compliance box and achieve certifications. Various teams and stakeholders try to skate through the compliance process by providing answers that reflect what they think the enterprise customer wants to see (vs. the reality).

In order to achieve long term growth, financial institutions (FIs) and cannabis companies alike need to start executing compliance plans. FIs are always seeking new growth and revenue opportunities, and cannabis companies are constantly under the scrutiny of regulators. Identifying new solutions that can help companies grow quickly while also maintaining compliance should be an essential part of the roadmap.

Financial Institutions and Cannabis

Many think that financial institutions and cannabis businesses would be on opposite ends of any spectrum. Banking is a mature and established industry, while legal cannabis is a new, fast moving and constantly evolving space. So, on one side, there is a risk averse fiscally conservative and traditional business model, and on the other side is an industry that is outside of the mainstream.

Let’s look at this perception from a different angle though. What is true is that both industries are highly regulated and must comply with the rules placed upon them by regulators; and if their house isn’t in order, the consequences can be disastrous (Read: Massive fines or even losing the ability to operate). CRBs and FIs deal with the security and dual control of inventory, and making sure customers are properly identified and of legal capacity to conduct business. In most cases, both are small businesses within their respective communities.

Moreover, each of the industries are forced to navigate nearly-constant regulatory change, making the act of complying with applicable regulations a moving target. For most of these types of businesses, regulatory compliance is cited as one of the largest (and most expensive) challenges they face in day-to-day operations.

Compliance as Revenue Protection

When financial institutions make the decision to offer services to the cannabis industry, they naturally look at the market opportunity to determine whether the effort associated with the increased compliance obligations outweigh the potential benefits. Traditionally, compliance is viewed as a cost center, but in reality, it’s a revenue protection center. As the old saying goes; “an ounce of prevention is worth more than a pound of cure.” Compliance is that prevention.

Failing to fully comply and meet regulatory compliance standards can cost organizations billions. Having a trusted system of compliance established should not be looked at as a cost-sucking measure for businesses, when it really is negligible when the cost of getting it wrong is far more substantial. Setting up a truthful and transparent compliance program isn’t just the right thing to do, it also protects revenue.

As the cannabis industry continues to grow, navigating around pain points is becoming increasingly expensive for the companies participating in it, many of whom are still struggling to turn a profit. Specifically, an IDC forecast shows global revenue from GRC solutions growing from $11.3 billion in 2020 to nearly $16.2 billion by 2025. And the average business hires and spends upward of $50,000 to $200,000 on consultants to manage compliance. It’s not uncommon for companies to dedicate five to 10 people working on compliance every week for hours and months on end.

Many in the banking industry are worried about forging into a stigmatized stream of revenue like cannabis, but with the right compliance solutions in place, they can have peace of mind. These solutions guarantee that revenue from cannabis is done legally by analyzing where each dollar came from, and denying those that don’t meet the minimum criteria. Having visibility into cannabis-related business (CRBs) accounts that do the enhanced due diligence is the only way to operate.

By implementing purpose-built compliance management solutions, financial institutions are able to unlock new revenue streams and scale cannabis banking operations. Meaning that as cannabis continues to gain mainstream momentum, and becomes less scrutinized locally and federally, these FIs that take part will be ahead of the curve.

Looking Ahead

With recent movement towards legalization in the House, cannabis investors are optimistic about the industry’s future. So how can the cannabis market overcome these hurdles and remain highly profitable?

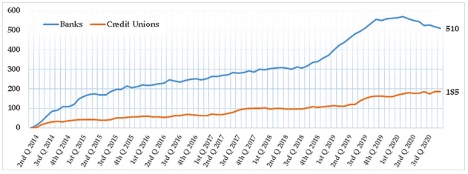

To start with, CRBs must have greater access to accredited financial institutions like banks and credit unions. Owning bank accounts, obtaining credit cards, and applying for small business loans is essential to growth. Providing CRBs with access to proper financial support and compliance control is crucial for the cannabis market to continue to thrive.

Federal legislation such as the SAFE Banking Act is currently thought of to be the silver bullet that will open the floodgates for CRBs and FIs to work together. But in reality, this is a myth, as the SAFE Banking Act will simply make the current compliance rules stricter.

To be a first mover FI in your area, businesses must start by implementing a scalable, verifiable cannabis banking program. The real customers and financial opportunities are out there, and are even greater than what you might have modeled given the growth of the industry. The ability to do this today is real.