The cannabis industry in the United States is booming. In just a few years, it has gone from a small, underground market to a multi-billion-dollar industry. This growth is due in part to the legalization of cannabis in many states, as well as the growing public acceptance of its use for both medical and recreational purposes.

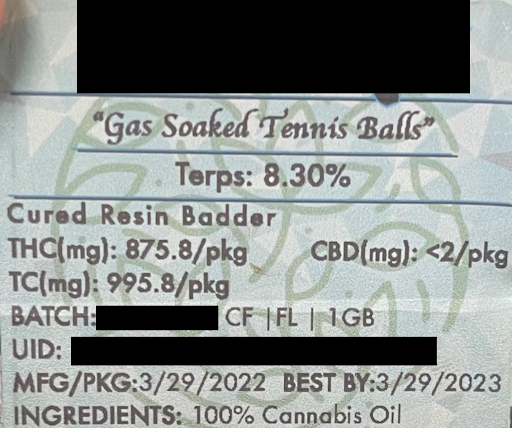

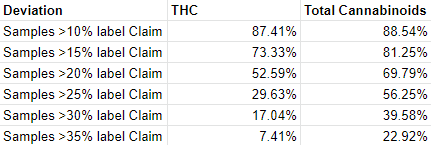

The industry is still in its early stages, but it has the potential to be a major economic driver for the United States. However, the industry’s success has brought with it challenges, such as THC inflation. This is when growers inflate the THC levels of their products in order to sell them for a higher price. This practice has led to widespread lab shopping, as growers send their products to labs that promise to give them the highest THC readings.

THC Inflation and Lab Shopping: A Look Under the Hood

Among cannabis enthusiasts, a prevailing belief circulates, asserting that cannabis products with elevated THC levels inherently possess greater potency and induce more pronounced effects. Nevertheless, this belief rests upon a fallacy, for it erroneously assumes that THC levels alone dictate the overall potency of a cannabis product. Genuinely comprehending the potency and effects of cannabis products requires the consideration of an array of factors. These factors include the presence of other cannabinoids and terpenes, the method by which the substance is consumed, as well as an individual’s metabolic and tolerance peculiarities. For instance, a particular strain of cannabis with low THC content, but elevated levels of other cannabinoids and terpenes, may engender a more intense impact in contrast to a variety exhibiting higher THC levels but diminished quantities of other compounds.

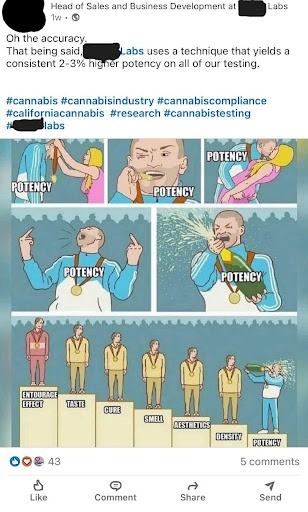

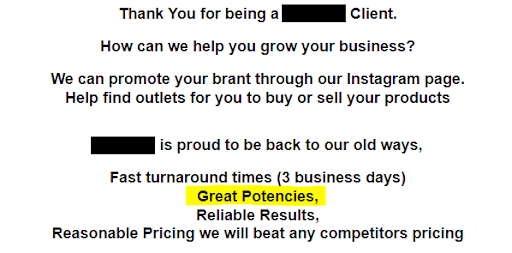

This misguided notion that heightened THC levels correspond to augmented potency has contributed to a surge in the demand for high-THC products. Consequently, producers have resorted to offering incentives to labs that provide inflated THC numbers for their products. Thus, certain labs have engaged in a practice coined as “lab shopping,” whereby they furnish reports that align with the producers’ desired THC levels, rather than accurately reflecting the genuine levels present within the product.

The manipulation of THC levels and the deceitful practice of lab shopping inflict profound damage upon the cannabis industry, eroding the foundation of trust. The fact that growers selectively collaborate solely with labs that yield desired outcomes, generates a mirage of superiority surrounding their products, thus deceiving consumers. Consequently, unsuspecting customers find themselves in possession of goods that fall far short of the promised standards of potency or quality. Moreover, this predicament places labs that remain steadfast in their commitment to integrity and the provision of accurate test results at an unfair disadvantage.

Fighting Back to Eradicate THC Inflation and Lab Shopping in the Cannabis Industry

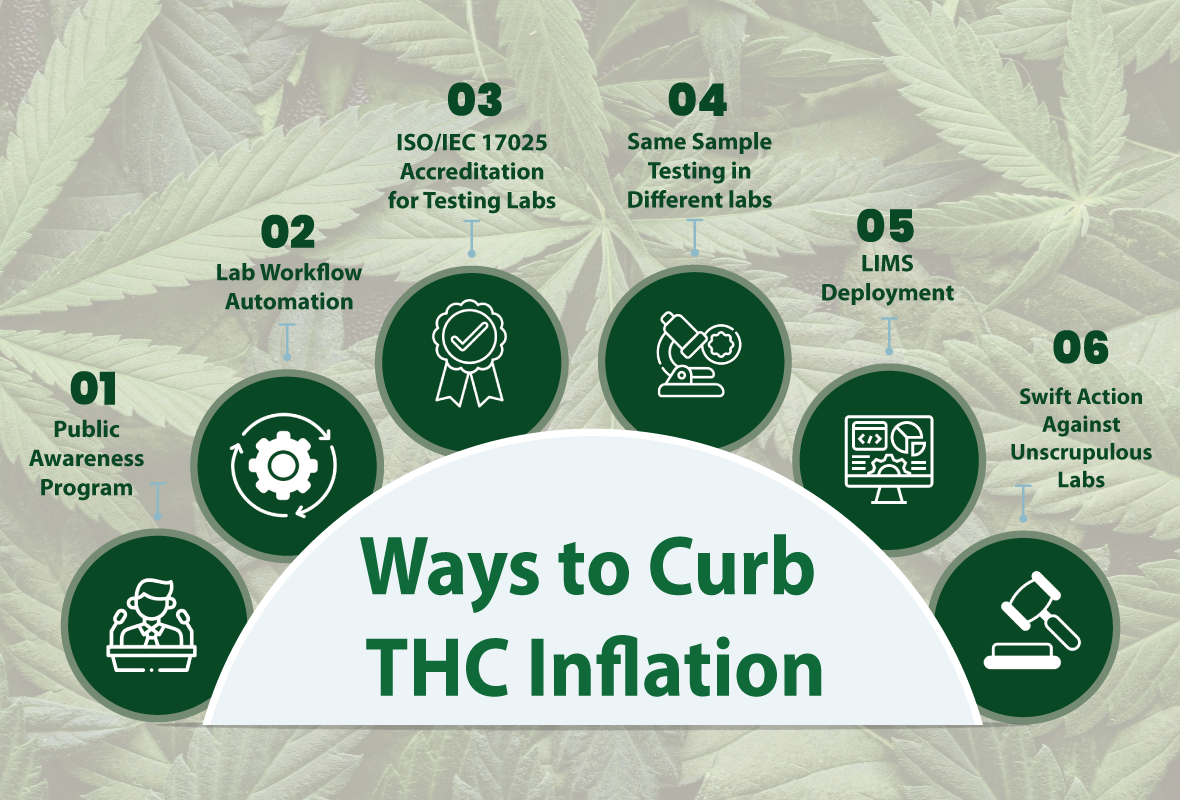

The relentless surge of THC inflation finds its origins in the glaring absence of standardized testing protocols within the cannabis industry. As each lab embraces diverse methodologies and tools, testing produces disparate outcomes. This dissonance becomes a fertile ground for unscrupulous labs, who seize the opportunity presented by this lack of uniformity to peddle false THC numbers. To compound matters, the scope for manual interference looms large. The solution to this problem is to create a set of standards that everyone in the cannabis industry must follow. It’s important for the industry to come together and establish a common set of rules for testing. This will ensure that all labs consistently follow the same procedures and produce accurate results. In addition, it is important to have different labs take part in proficiency testing to find outlier labs. States should also take quick action to punish labs that provide incorrect or exaggerated THC values in their reports.

It is extremely important to prioritize transparency among labs in order to address the growing concerns regarding the inflation of THC potency. State regulatory bodies can achieve this by conducting frequent audits to detect and correct any inconsistencies or inaccuracies in the data. To make this possible, state agencies need to hire skilled data scientists who can thoroughly analyze the data produced by labs. If the industry collectively works towards addressing these issues, it will enhance consumer trust in the regulated market. By eliminating the incentives that drive THC potency inflation, a more trustworthy cannabis industry can take shape and flourish.

Next, it is crucial to educate customers about the false notion that higher THC levels always result in stronger effects. Through effective communication and raising awareness, the industry can address the issue of THC potency and discourage the practice of selectively choosing labs with desired results.

Finally, labs should achieve accreditation to ISO/IEC 17025 as evidence of their competence in producing trustworthy results. This will help restore customer trust in the regulated cannabis industry and establish a stronger system for quality assurance.

The Importance of Deploying a Cannabis Lab Testing Software

Having a Laboratory Information Management System (LIMS) is essential to meet the challenging ISO/IEC 17025 requirements. This system plays a critical role in providing an extra level of assurance and trust in the accuracy of lab results. By automating processes, integrating analytical instruments, and adhering to rigorous quality standards, a cannabis lab testing software minimizes the possibility of manual manipulation of test results.

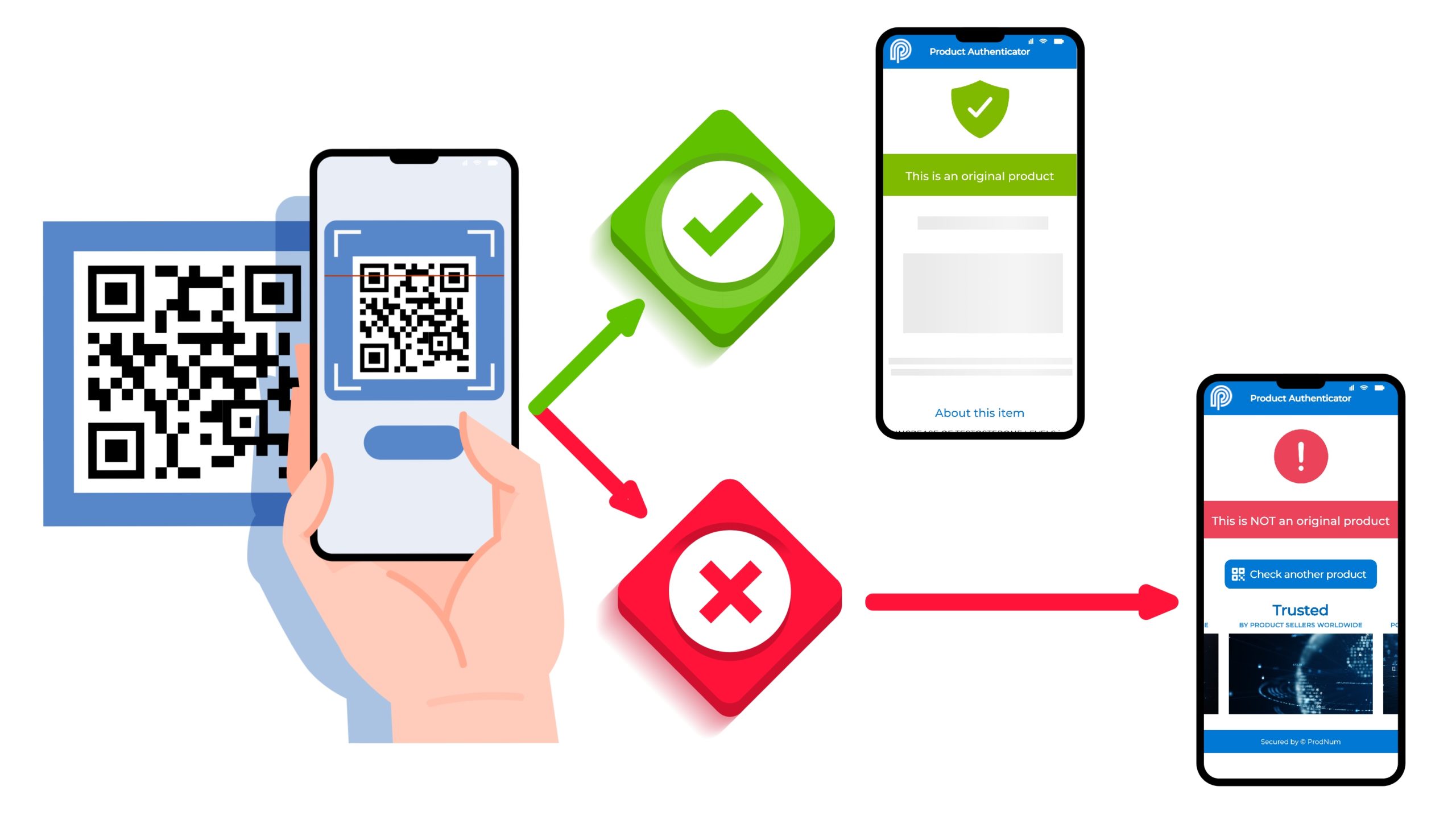

Furthermore, a cannabis lab testing software maintains a sample chain-of-custody (CoC) through the sample life cycle and tracks samples using barcodes. Furthermore, it generates custom reports that include scannable QR codes, which can be instantly shared with customers. By configuring the QR code, it becomes possible to include a link to the original Certificate of Analysis (CoA) produced by a lab. This allows buyers to verify the reported composition on the product label by referring to the authentic test results on the CoA. This approach promotes transparency, trust, and accountability within the cannabis industry.

A cannabis lab testing software carefully monitors and records all activities, such as staff logins, document modifications, sample records, and test results, with a date and time stamp along with the name of the person who performed those activities. This thorough record-keeping process eliminates any chance of manual tampering with lab data, thereby enhancing the reliability and defensibility of test results. Moreover, the system effectively manages the outcomes of various Quality Control (QC) samples to guarantee accurate test results. By comparing the test results of QC samples with the samples being tested, the system can identify any analytical errors and enable lab managers to fix them, enabling labs to uphold quality standards.

The cannabis industry has experienced swift expansion as a result of cannabis legalization in multiple states across the United States. This has brought about various advantages, such as increased demand for cannabis products and the creation of new employment opportunities and tax revenue. However, the industry has faced challenges such as the issues of THC inflation and lab shopping. Dishonest producers and labs take advantage of the lack of standardized industry practices to deceive regulators and consumers. To address this issue, it is crucial to establish industry-wide testing standards that ensure consistency and accuracy across all labs. State agencies must also take prompt action to penalize labs that provide false THC values. Additionally, educating consumers about the misconceptions surrounding high THC levels and potency is important to combat this detrimental trend in the industry. Implementing cannabis lab testing software can help reduce the potential for human error and guarantee the authenticity and reliability of lab data.

This nascent but fast-growing industry holds remarkable promise for medicine and the economy, which can only be realized if proper safeguards are put in place and malpractices are stopped in their tracks.