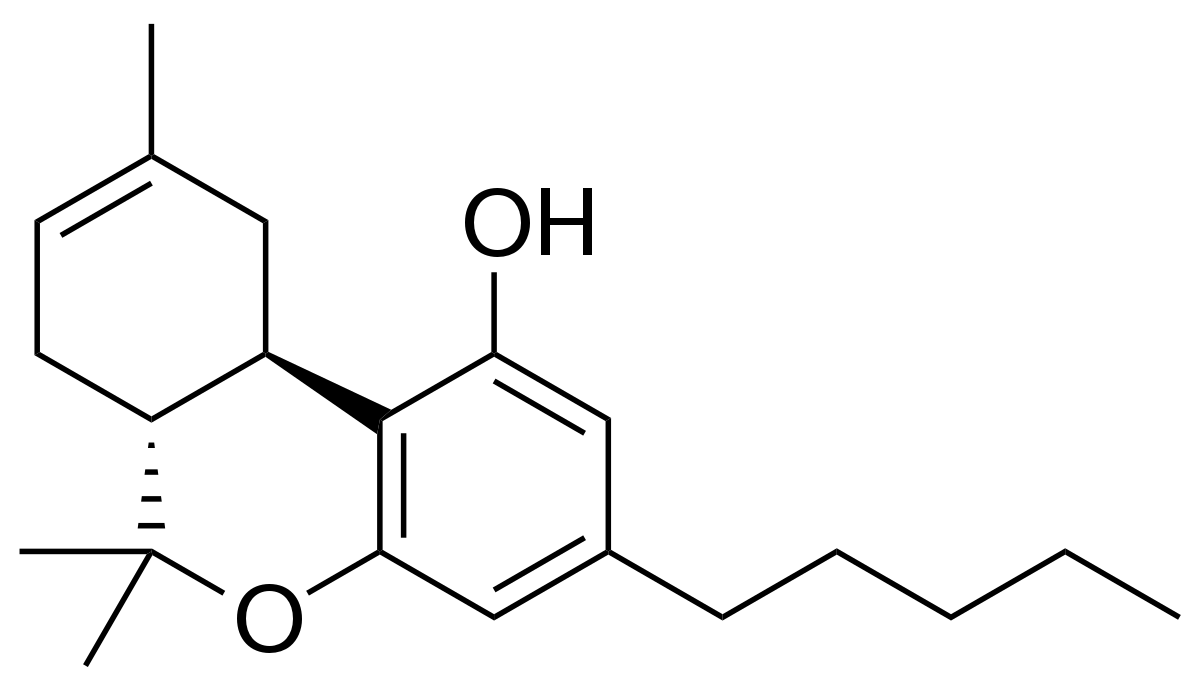

Natural cannabinoid distillates and isolates are hydrophobic oils and solids, meaning that they do not mix well with water and are poorly absorbed in the human body after consumption. Cannabinoid oils can be formulated into emulsions to form a fine suspension in water to modulate bioavailability, stability and flavor.

Happy Chance is a cannabis infused products company offering better-for-you products to their customers. Happy Chance recently launched a low-glycemic index fruit bite line made from fresh ingredients, distinguishing them from traditional gummies. Splash Nano is a cannabis infused products ingredients company specializing in nano emulsions. Happy Chance utilizes Splash Nano technology in their fruit bites formulations.

We spoke with Katherine Knowlton, founder of Happy Chance, and Kalon Baird, co-founder and CTO of Splash Nano to learn more about their products and how they came to do business together. Prior to Happy Chance, Knowlton worked as a chef. Prior to Splash Nano, Baird was a consultant to the cannabis industry.

Aaron Green: Katherine, how did you get involved in the cannabis industry?

Katherine Knowlton: I am a chef by trade. I went to culinary school in 2015. My partner also got into the cannabis space in 2017, which was right around the time when adult use cannabis became legal in California. As a chef, I am very passionate about cooking for optimal health and well-being. I noticed right away the abundance of candy- and sugar-laden products on the market. I set out to create a wellness driven product blending healthy, whole foods with a better value proposition, better-for-you and better-for-the-planet.

Green: Okay, great. Kalon, same question: how did you get involved in the cannabis industry?

Kalon Baird: I left a corporate job in 2011 and started cultivating in Southern California. I started to develop techniques for horticulture and developed a connection with the plant. I was a consultant for many years, and then decided to take a different path when legalization happened and got into the regulated manufacturing space. My goal was to bring new products to market to help satiate the demand for the infused category, the non-smokeable categories and to pursue niche product development.

Green: Tell me about your recent product development interests?

Baird: We’re interested in the research that comes out regarding cannabis minor constituents. We work with other research labs doing two-dimensional chromatography. We’re trying to figure out what compounds exist in the plant that aren’t just the major cannabinoids, and how to work with them in a pharmacological context so that they can be standardized and replicated at scale.

So, it’s not just about making a sugary THC gummy, it’s about seeing what minor cannabinoids, what minor terpenoids and what other unknown compounds can we explore, and then put back into products.

Green: That’s 2D GC-mass spec?

Baird: Yeah, it’s GC-by-GC and tandem mass spec. There are only a couple people that make that piece of equipment. The lab that we work with on that project is called Veda scientific. They’re one of the only people in the cannabis space that uses that machine. And they’re right in our backyard. The tech enables us to further quantify terpene profiles and helps to differentiate our products.

Green: I’d like to focus first on the Splash Nano technology and then we’ll dig into how you got to know each other, and then we’ll finish off with learning more about Happy Chance. So Kalon, tell me more about Splash Nano.

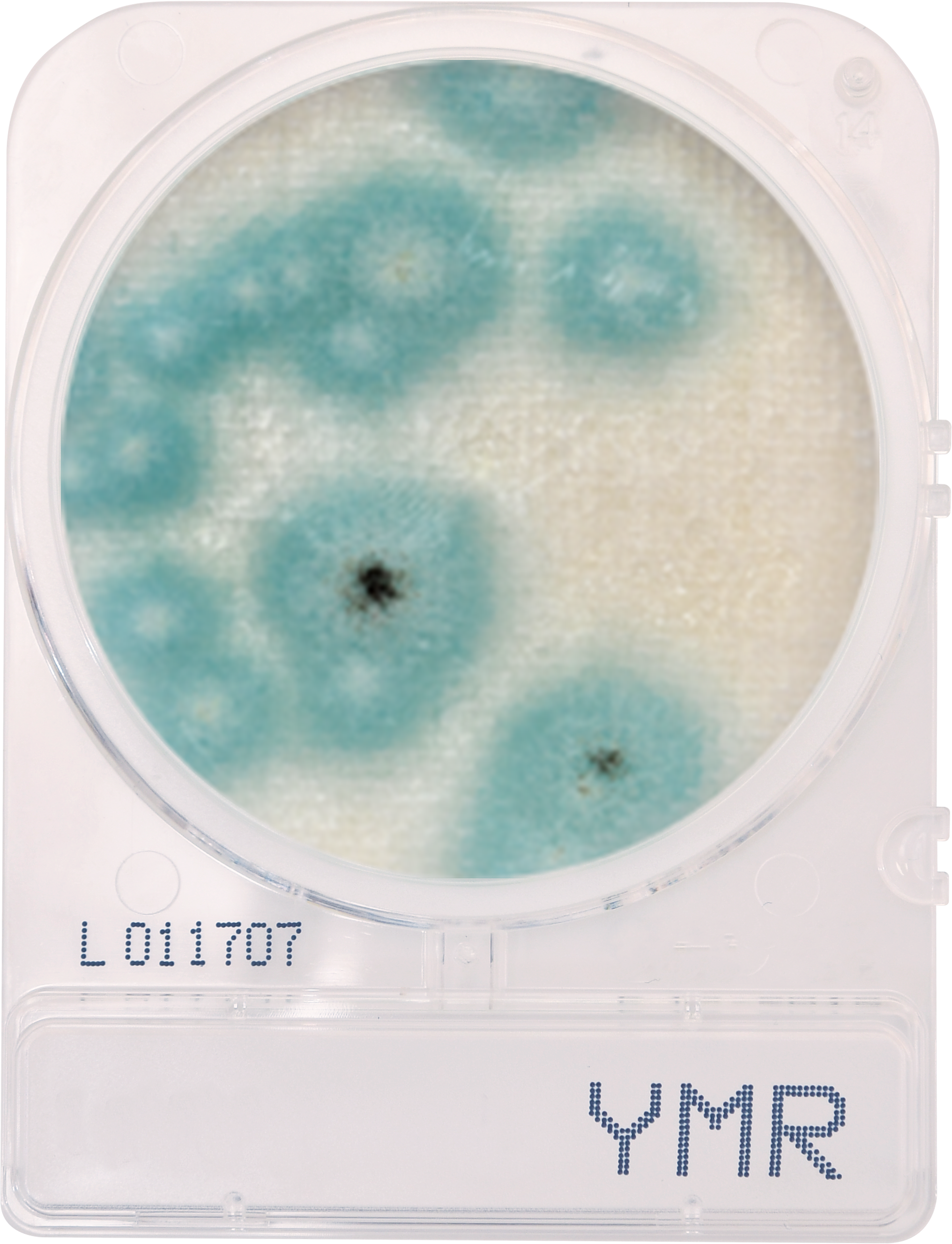

Baird: We employ nano emulsion technology. It’s essentially the science of making oil and water compatible and suspended in a way that reduces droplet size. With nano emulsions, you create an interfacial layer that enhances absorption and solves technical problems like being able to make cannabis oil compatible in water-based matrices, and sometimes in non-water-based matrices. The idea is that as we spread out the particles and as we change attributes of how they’re coated, they’re more bioavailable, and you get a more consistent and faster onset experience like you would in the pharmaceutical or alcohol industry. It’s bringing the industry standard up to the consumer package level and the pharmaceutical level, so that people aren’t waiting the typical hour-long timeframe to absorb that first dose.

Green: Tell me about your business model.

Baird: When we started out in 2018, we were going for a manufacturing license. In the meantime, we saw the drink category evolving and we wanted to be a part of that conversation in that ecosystem. We started developing our own nano emulsions that we knew would be useful when we got our license. We knew that we would sell the base material to co-packers who would put them into beverages. We didn’t want to co-pack the beverages ourselves. So, we developed a drink additive that was our proof of concept that had legs for the technology so that we could show people how to use it. That proof of concept spun off and became its own product and now it’s in the market under the brand name Splash Nano and comes in four distinct product SKUS using minor cannabinoids as differentiators.

Meanwhile, our bread-and-butter business was working with smaller brands, like Happy Chance that needed a path to market but couldn’t get the license or couldn’t go through that whole rigmarole of a two-year waiting period and a half a million dollars and all the other stuff. So, we started taking on all these smaller brands effectively licensing their brand IP and their ideas. In the process, we ended up learning a ton about product development and it became kind of a passion.

We have three core revenue streams. One of them is contract manufacturing, or private labeling. The other one is our own product Splash Nano which is a drink additive. And then the last is we open sourced the technology and sell that as a business-to-business platform so that people can infuse their own products with our fast-acting emulsions. We’re working on a licensing model that will allow other states to create that same consistency, where we send a black box model out to them, and then they infuse the cannabis and then turn that into a product.

Green: Moving on to Katherine here. Tell me about Happy Chance, and how you came up with the brand concept and the product idea.

Knowlton: Going back to what I touched on earlier, many traditional edibles in the space are brownies, cookies and candy type of products that do not contribute to wellness. I wanted to give the wellness driven consumer an option in cannabis. I wanted to create a powerhouse edible that was not only functional and complete but that elevated the consumer’s experience as a whole because of the ingredients we choose and the whole cannabis we source.

I’m someone who values better-for-you products that contribute to optimal health and well-being. So, I set out to make something. I didn’t really know what I wanted to make in the beginning. I bought a dehydrator and a food processor, and I started messing around with different applications in my kitchen. Over 100 variations later, the fruit bite was born.

The fruit bite is made with dates – a natural sugar that delivers nutritional power: a low glycemic index and high in vitamins, minerals and antioxidants. A sweet you can feel great about. And we use pumpkin seeds which have a lot of great protein. We are working with a company in California that takes imperfect fruits and vegetables and upcycles that back into the food supply chain. We utilize the whole fruits and vegetables as a dried intermediate, capturing all the flavor of nutrients. No added natural flavors and nothing from concentrate.

Green: How does the consistency differ from a gummy?

Knowlton: The consistency is similar to a Lara bar or an Rx bar. Essentially, it’s that same consistency in a bite form and so it’s very different than a gummy. It’s a low dose, low sugar alternative to the modern-day gummy.

Green: So, you’ve got this healthy concept for the fruit bite. You’re looking at suppliers and technologies to infuse the product. How did you finally decide on Splash Nano?

Knowlton: I watched my partner lose his company a few years ago to a larger vertically integrated company. The MSO promised the moon and the stars, and they got lost in the weeds of their eco-system, ultimately losing their company. That said, I was very sensitive when I first started on this journey. I even took on my own partners who didn’t work out either. I spoke with a lot of manufacturers in the selection process. Splash Nano was the tenth manufacturer I spoke with.

It was a very organic way of meeting. I am also based in Santa Barbara where Splash Nano is located. My partner’s brother shared an office space with Kalon, so we met through that connection. I learned right away that Splash was founded on wellness, much like Happy Chance. It was important to source clean cannabis, an aspect that Kalon and his team take pride in. We quickly discovered that Kalon’s Splash Nano technology was going to work in my product. Happy Chance immediately found a home, and it has been an organic evolution of realistic business and friendship.

It was a very organic way of meeting. I am also based in Santa Barbara where Splash Nano is located. My partner’s brother shared an office space with Kalon, so we met through that connection. I learned right away that Splash was founded on wellness, much like Happy Chance. It was important to source clean cannabis, an aspect that Kalon and his team take pride in. We quickly discovered that Kalon’s Splash Nano technology was going to work in my product. Happy Chance immediately found a home, and it has been an organic evolution of realistic business and friendship.

Green: Kalon, I’d love to get your perspective as well. How do you think about partnering with brands?

Baird: Because of our contract manufacturing experience, we’ve been able to touch approximately 50 brands over our three-year tenure in this space. We’ve seen kind of everything from the multi-state operator to the owner-operator and everything in between. I developed a passion for working with these smaller brands for a lot of different reasons. This industry is built on the success of small mom and pops. Yes, the multi-state operators do have a place and they absolutely add a lot of value. But at the same time, they have their own natural challenges. You have essentially a culture of employees versus a business owner that’s making a lot of their own decisions.

There are advantages to somebody like Katherine, who’s in the trenches of business, and understands the ebbs and flows and ups and downs of this industry and be able to get through some of those challenges a lot more organically and a lot more sustainably. Katherine has such a deep pulse on her business and on her customer and on her own money. She tends to make a lot more calculated decisions, and I really appreciate that.

There are advantages to somebody like Katherine, who’s in the trenches of business, and understands the ebbs and flows and ups and downs of this industry and be able to get through some of those challenges a lot more organically and a lot more sustainably. Katherine has such a deep pulse on her business and on her customer and on her own money. She tends to make a lot more calculated decisions, and I really appreciate that.

There’s a lot of waste that gets accumulated in this industry through packaging, through bad decisions, and over extensions of capital. It’s sad to watch and you see these people that have great potential, but it’s kind of lost in this sort of the framework of a large organization. Again, I like multi-state operators, they’re great. There’s nothing wrong with them, but it’s just a different flavor. I’m trying to highlight the fact that working with somebody that has a pulse on her business, and the passion for what she’s doing is wonderful. It’s not just about making money; it’s about adding value.

Green: Katherine, talk to me about sustainability and how you’ve woven that into your product.

Knowlton: We’re dedicated to supporting Product, People and Planet. That’s the whole mission and ethos of Happy Chance. As a chef, I wanted to be intentional about where our ingredients come from. We only source organic and upcycled ingredients – an essential recipe in sustaining a healthy, eco-friendly plant. Intention and integrity are always at the forefront of our products. We prioritize partnering with more transparent supply chains. We want to show the world how cannabis can promote positive lifestyle changes that support living more actively and consciously.

To reiterate, we are also not using anything from concentrate. We are using the entire strawberry, the entire blueberry and so it encapsulates all the flavor and all the nutrition that you would have from a fresh fruit into our products.

Green: How do you think about sustainability in product packaging?

Knowlton: As far as packaging goes in this industry, we’re very limited in what we can do. Compostable packaging isn’t really available, but we have partnered with a packaging company that definitely has mindfulness at the core of their mission. They have established their entire supply chain to ensure they are focusing on green practices and reducing waste each step of the way. Their energy efficient machinery creates a zero-waste manufacturing process to reduce their carbon footprint and they utilize soy and vegan inks to help reduce air pollution by minimizing toxic emissions in the air. My hope for the industry is that as it continues to evolve, we can become less wasteful as far as packaging goes.

Green: Rapid fire questions for both of you: What trends are you following in the industry right now?

Knowlton: As a chef and coming from the CPG world, I’m passionate about health and wellness. I think that it’s important to stay on trend with what we’re seeing in CPG. There’s definitely a market as far as people wanting these better-for-you products. I want to bring that into the cannabis space.

Baird: We’re seeing the inclusion of minor cannabinoids, terpenoids, standardized recipes and faster- or slower-acting delivery systems. So, I’m following trends in advanced drug delivery systems paired with minor cannabinoids.

Green: What are you most interested in learning about?

Knowlton: I’m most interested in how I can take what I’ve learned in the food space and help bring that into the world of cannabis through Happy Chance. Ultimately cannabis is plant medicine. So, how can we educate people that the ingredients we choose to make products should be good for us too. I think that there’s a lot that can be done with it from a from a health and wellness standpoint.

Baird: I’m interested in learning more about the analytical overlay between quantifying and standardizing entheogens and plant medicines like cannabis into the product development process in CPG. I’m thinking of ways to blend the two worlds of traditional science and New Age medicine.

Green: Awesome, that concludes the interview. Thank you both, Katherine and Kalon.