A little over a year ago, we at AB FinWright took a look at the newly-opened adult-use cannabis market in Montana and posed the question: Is Cannabis the Next Gold Rush for Montana? Now, with our 20-20 hindsight, we can see that cannabis sales have taken off in the Treasure State and the tax dollars are rolling in. But political infighting has arisen that threatens to derail the will of the voters who approved adult-use. In addition, arbitrary local approval has set many cannabis entrepreneurs on edge, wondering if they’ll have a business a year from now.

Sales: Predicted Versus Actual

When voters passed Initiative I-190 in 2020 and adult-use commenced January 1, 2022, the Cannabis Control Division (CCD) of the Montana Department of Revenue expected total adult-use sales in 2022 to top $130M. Montana’s imbibers blew that figure out of the water. By the end of last year, the Treasure State had notched up almost $210M of adult-use sales, alongside $93M of medical sales, for a total of almost $304M. With a state population of only 1,085,000, that translates into $280 of cannabis sales per capita. For context, Oklahoma sold $214 of cannabis per person in 2022, while California did only $135/person last year. (It’s estimated that 55% of California’s sales are made by illegal dispensaries, which would translate into a far more robust total of $301 of cannabis/person.)

How Has the Tax Situation Changed in Montana?

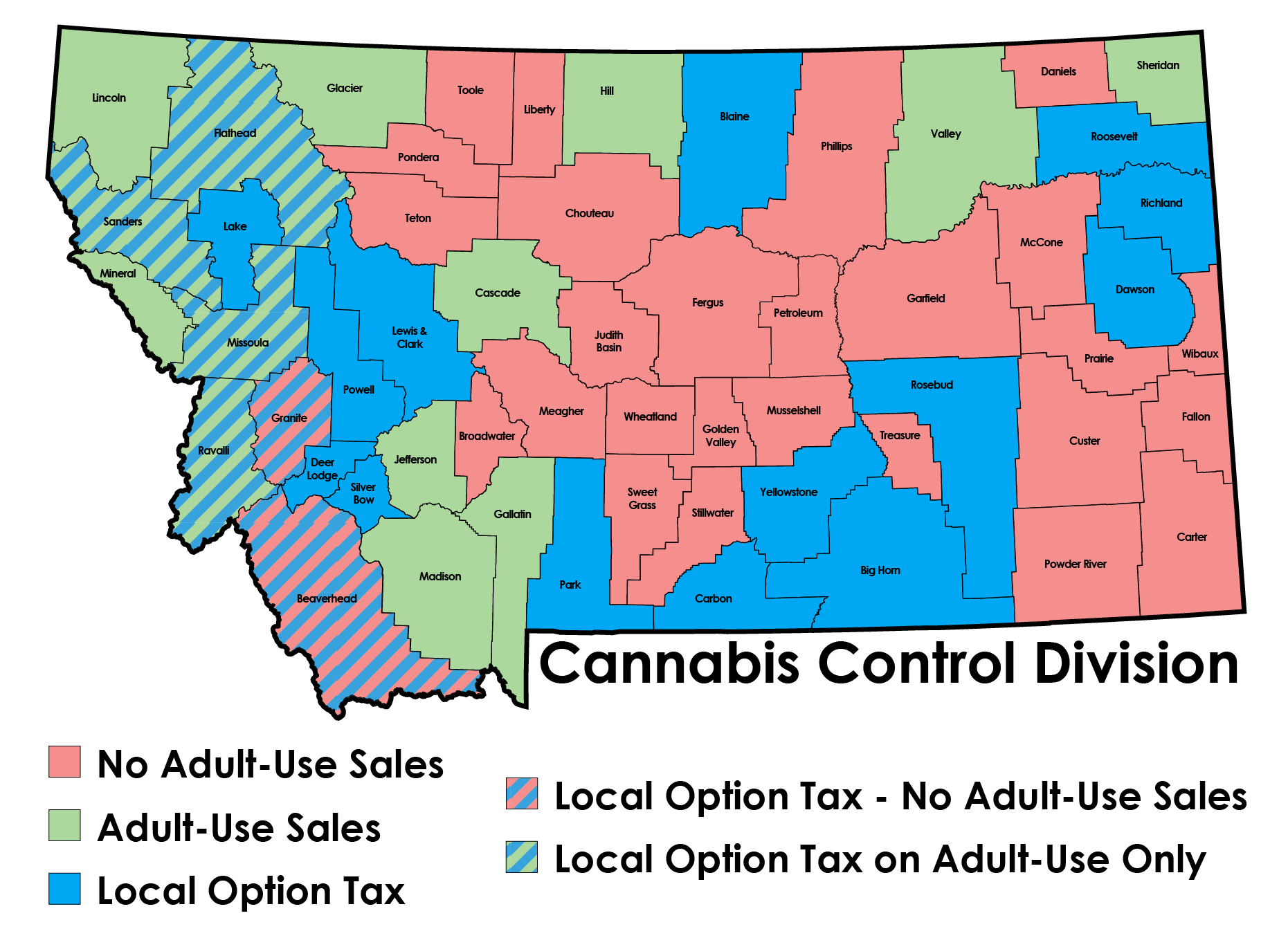

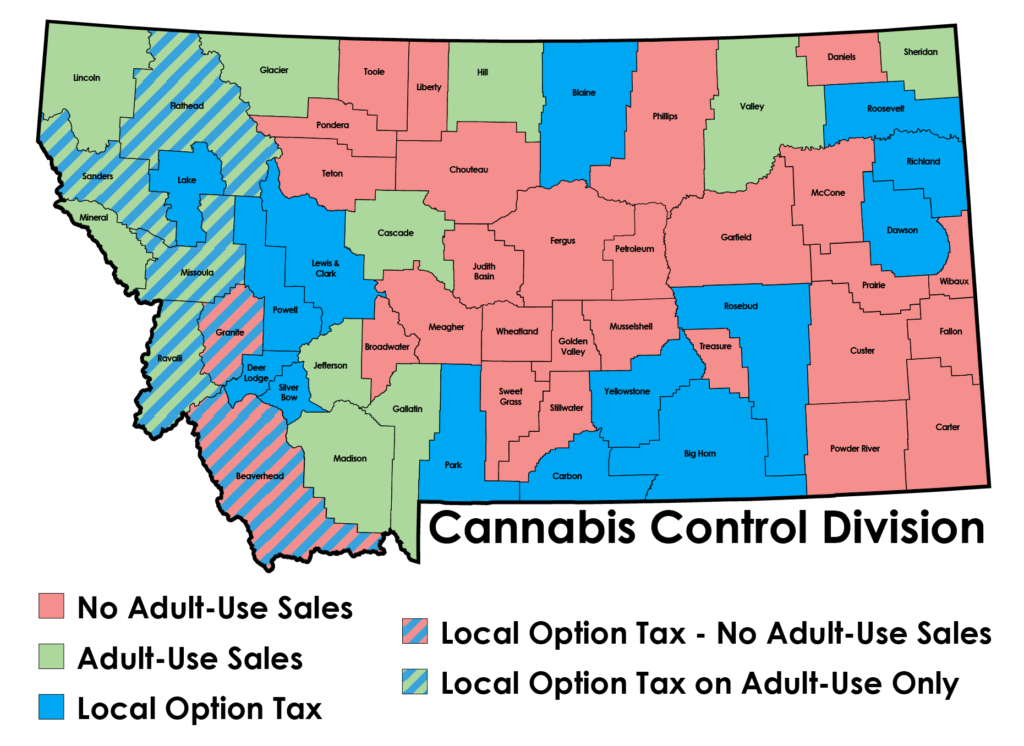

At the beginning of 2022, we noted that Montana charges a 4% cannabis tax on medical sales and a 20% cannabis tax on adult-use sales. A 3% maximum local tax was part of the new law, but only 3 counties had enacted it. Fast forward a year and 17 more counties have chosen to enact the local tax, all of them charging the maximum 3%. 10 states allow adult-use sales and have no local tax, which leaves 26 counties that have prohibited adult-use sales (the red counties).

At the beginning of 2022, we noted that Montana charges a 4% cannabis tax on medical sales and a 20% cannabis tax on adult-use sales. A 3% maximum local tax was part of the new law, but only 3 counties had enacted it. Fast forward a year and 17 more counties have chosen to enact the local tax, all of them charging the maximum 3%. 10 states allow adult-use sales and have no local tax, which leaves 26 counties that have prohibited adult-use sales (the red counties).

The good news: wholesale sales are exempt from cannabis taxes, and there is no regular sales tax on retail sales, so there is no tax-on-tax (unlike California, which has sellers calculate and collect sales tax on the sale price of their cannabis products plus the cannabis excise tax they’re required to collect).

Montana does not follow Internal Revenue Code 280E and allows normal business deductions for licensed (legal) cannabis corporations, as well as pass-through entities and individuals with licensed cannabis operations.

As State Cannabis Tax Revenue Goes Up, Fights Break Out Over the Funds

Total cannabis tax revenue for 2022 was almost $46M and is projected to rise to $53M for the fiscal year 2023-2024, which starts this July 1, 2023.

Eyeing this revenue, Governor Gianforte (R) initiated House Bill HB 462 on February 17, 2023, whose intent is to funnel revenue away from state parks and wildlife as approved by the voters, and more towards law enforcement and the state’s general fund.

I-190, along with approving adult-use cannabis, specified that the first $6M in tax revenue would go for the state program Healing and Ending Addiction through Recovery and Treatment. All remaining funds would be split between the general fund 65%, various parks and wildlife programs (32%) and veterans and surviving spouses (3%).

I-190, along with approving adult-use cannabis, specified that the first $6M in tax revenue would go for the state program Healing and Ending Addiction through Recovery and Treatment. All remaining funds would be split between the general fund 65%, various parks and wildlife programs (32%) and veterans and surviving spouses (3%).

HB 462 would see the general fund receiving 75%, law enforcement 7.5%, veterans and surviving spouses 5%, with parks and wildlife reduced to 12.5%. Many feel this subverts the will of the electorate.

On almost the same day as HB 462 was introduced, another bill was put forward, AB 420, which would eliminate the 4% cannabis tax and 3% local tax on medical marijuana. The bill’s sponsor, Representative Mike Hopkins, a Republican from Missoula, believes that adult-use tax revenues are “more than capable” of funding the adult-use program as well as the other addiction and parks and wildlife programs enumerated in I-190. The bill is being countered by the Montana League of Cities and Towns which believes that repealing that tax would create a $4.5M dent across those communities who instituted the local tax.

Both bills have been tabled in committee and will continue to be debated in the second half of the 2023 legislative session.

Retail, Cultivation & Manufacturing – Grandfathered Licenses Only, for Now

Original adult-use legislation stated that, from January 1, 2022, until July 1, 2023, only Montana medical licensees who were licensed on November 3, 2020 (or had an application pending with DPHHS on that date) might be issued a license for cultivation, manufacture or sale of adult-use marijuana. In an explicit effort to give current Montana-based dispensaries a temporary advantage over out-of-state players, the new law imposed an 18-month moratorium on all new licenses. Once the moratorium expires, new license holders will be limited to a small Tier 2 license, which restricts the amount of cannabis they can grow.

New license holders will need to show one year of Montana residency in order to even apply. That being said, there’s nothing stopping an out-of-state business from buying an existing business from a current Montana resident.

In an update to this legislation, a rider was recently added to HB 128 that would extend the licensing moratorium two more years, to July 1, 2025. The bill was approved by committee on February 14, 2023 and will come before the House later in this legislative session. In a recent presentation on cannabis in Montana, Bozeman cannabis attorney Christopher Young commented, “I’ve talked to Jason Ellsworth (R, Senator, President of the Montana Senate), and I’ve been told HB 128 is going to pass.”

HB 128 Has Many Medical Cannabis Businesses Worried

The number of medical cannabis cardholders has dropped drastically since adult-use became legal, from 40,522 registered cardholders on January 1, 2022, to 22,325 on January 1, 2023, a reduction of 45%. For those dispensaries that initially chose to remain exclusively medical (18% of all dispensaries), as well as those that, for one reason or another, missed the boat to sell adult-use, they have seen a significant decline in revenue. Consequently, a significant number have been eagerly awaiting the July 1, 2023 to apply to sell adult-use cannabis. The possibility of having to wait an additional two years has them very concerned.

At a hearing on HB 128, Norman Huynh of Pacific Valley told lawmakers he believes he can’t continue to sell only to medical cannabis cardholders because he doesn’t make enough. “There are only a finite amount [sic] of cardholders left,” he stated.

An adjustment in HB 128 is being debated which would allow 16 medical shops to become adult-use that had applied for adult-use before January 1, 2022 but who didn’t complete the process. Without this adjustment, many of these medical dispensaries believe they’ll face bankruptcy.

Opt-In, Opt-Out – Fickle Counties Have Cannabis Companies Nervous

Initiative 190 legalized adult-use cannabis by default in the counties that voted for it. In 2021, the Montana legislature hammered out implementation of adult-use cannabis in House Bill 701, and one provision of this bill allows counties and municipalities to vote to opt-out of legalization.

Granite County, which became a green county when nearly 55% of voters approved I-190, chose to do just that, opting-out of adult-use sales on June 7, 2022. The county’s sole dispensary, Top Shelf Botanicals, had begun selling to recreational users and estimates 80% of its customers are now adult-use. It has responded to the opt-out by drafting a new initiative to get voters to opt-back-in to adult-use sales. Their struggle to re-win the hearts of Granite County’s voters is ongoing and appears to be an uphill battle.

While Granite is the first county to opt-out of adult-use sales, changing them from a green county to a red county, movement is under way to opt-out in Cascade County, Carbon County, Ravalli County and Flathead County, among others. The opt-out movement is gaining strength in the state and has Montana dispensaries concerned. “The opt-out provision is very problematic, and I think it’s more problematic than people recognized at the time,” says Kate Cholewa, lobbyist with the Cannabis Industry Association. “What other business would people accept being in the position of potentially losing their business every two years?”

Taxability of Discounted Products – Department of Revenue Parses the Details

Initially, it was thought that the Department of Revenue required cannabis tax to be assessed on the regular retail price of a product, even though that product might be discounted. However, the DOR now says this is not always the case. “If the discount is offered to all customers, as opposed to a discount that is offered to only a particular individual or group, the established retail price can change.”

Examples where the discounted price becomes the new, lower established retail price: every Friday you offer everyone a 20% discount on certain products, or, you offer discounts to medical cardholders only. An example of when you must charge cannabis tax on the original, non-discounted price: a discount offered to a particular group, such as veterans or students. (Why medical cardholders are not considered a particular group is unclear, but this information is from the state’s website.)

Tax Comparison to Other States

We stand by our original assessment that Montana is actually a low-tax state for cannabis operators. First of all, it doesn’t follow federal statute 280E, but instead allows the deduction of regular operating expenses on state income taxes. In addition, unlike some states like California, Montana does not charge sales tax on top of cannabis taxes i.e., it doesn’t charge tax-on-tax.

If one examines tax rates, while Montana’s adult-use tax is high at 20%, its medical tax of 4% is a low one. The local tax of 3% (compared with Los Angeles’s 10% adult-use local tax, for example) is quite low and is not charged by 37% of the counties that have adult-use sales.

And if AB 420 is passed and the medical and local cannabis taxes are repealed, Montana will truly enter the ranks of low tax cannabis states.