CBD Intro

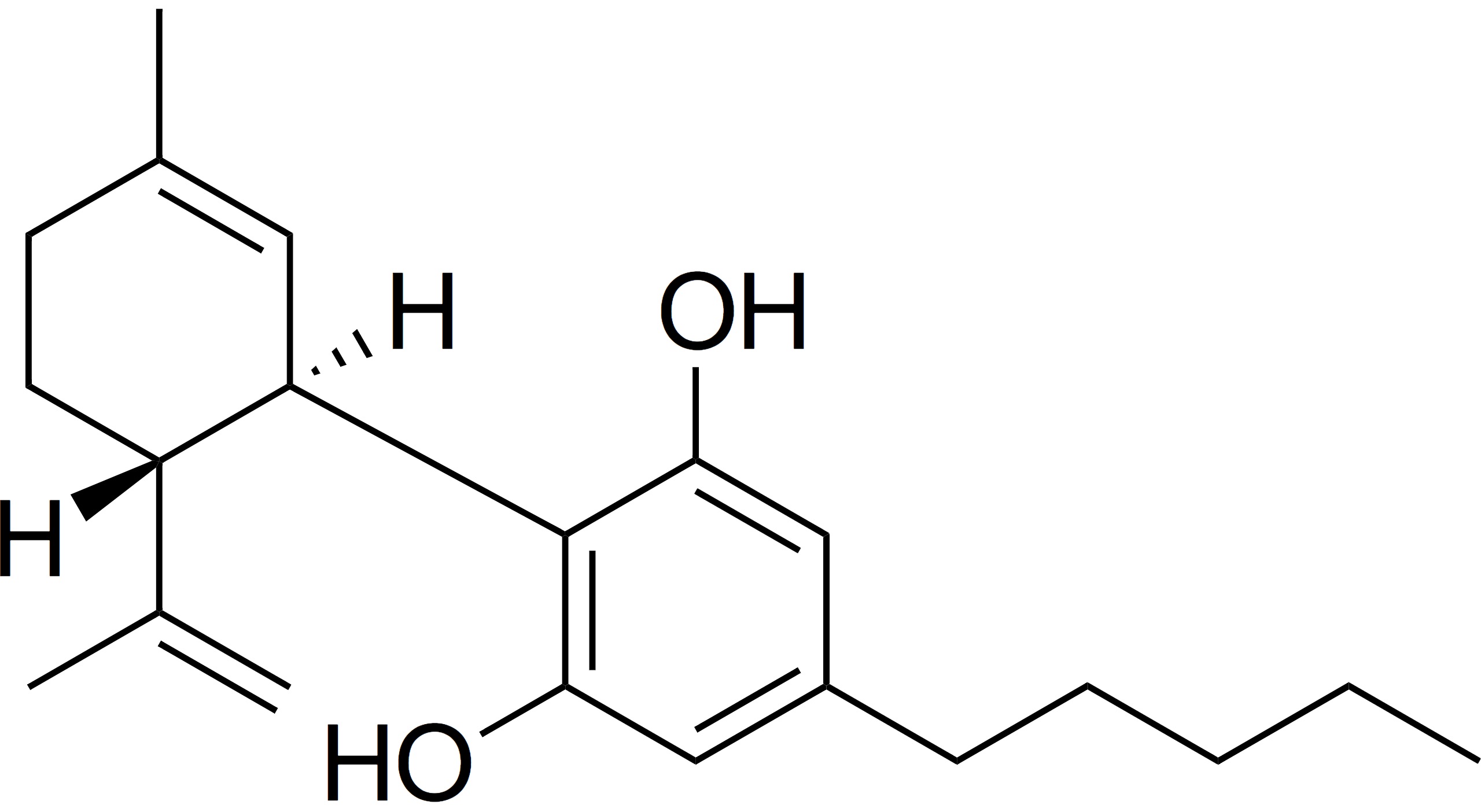

Cannabidiol, or CBD, is one of over 1000 cannabinoids found in the Cannabis plant. CBD was identified as an isolate from Minnesota Hemp in the 1930s (Gururajan, 2016). Unlike many other cannabinoids and compounds found in cannabis flower, CBD is not adversely psychoactive. CBD, upon its discovery entered the field of vision for US regulators. There are two routes of regulation for the FDA under the 1938 Food, Drug, and Cosmetic Act – as a drug and as a food (Oconnor, 2018). The FDA has jurisdiction over drugs in a broad sense from border to border, intra and interstate. Their jurisdiction over food, however, only extends to food that crosses interstate lines. CBD therefore, because of potential food uses and medicinal uses, darkens what is already a muddy regulatory landscape.

CBD as a drug

Under the FD&C Act, a drug is defined as “any product, including a cannabis product (hemp or otherwise), that is marketed with a claim of therapeutic benefit, or with any other disease claim (Mayol, 2019). In 1995, Cannabidiol was identified as a possible solution to help combat epilepsy. Since 1995, studies have been performed to evaluate the effectiveness of CBD to treat epilepsy and lessen the frequency and severity of seizures. In 2018, the FDA approved the first cannabidiol drug, brand named Epidiolex (White, 2019). Drug approvals under the FDA jurisdiction require specific approval before they can be launched into market. That is, while Epidiolex has a specific approval, this approval does not lead to implicit approval of similar CBD drugs that treat other illnesses.

Under the FD&C Act, a drug is defined as “any product, including a cannabis product (hemp or otherwise), that is marketed with a claim of therapeutic benefit, or with any other disease claim (Mayol, 2019). In 1995, Cannabidiol was identified as a possible solution to help combat epilepsy. Since 1995, studies have been performed to evaluate the effectiveness of CBD to treat epilepsy and lessen the frequency and severity of seizures. In 2018, the FDA approved the first cannabidiol drug, brand named Epidiolex (White, 2019). Drug approvals under the FDA jurisdiction require specific approval before they can be launched into market. That is, while Epidiolex has a specific approval, this approval does not lead to implicit approval of similar CBD drugs that treat other illnesses.

Bottom line: CBD is a recognized drug for use to treat epilepsy. Future use as a drug needs to be approved by the FDA.

CBD as an ingredient

What is seemingly the easiest route to market for CBD derived products is increasingly complicated. For ingredients, the easiest road to allowance in food is to be identified as Generally Recognized as Safe (GRAS). GRAS status is granted to ingredients that have been studied and deemed safe for human consumption by FDA-recognized experts. CBD, to date, is not GRAS. Without GRAS status, the FDA has similar mandates to CBD as a drug above. Ingredients must gain premarket approval prior to being offered for sale in interstate commerce.

Bottom line: CBD is not a recognized ingredient in food – it is neither premarket approved by the FDA nor accepted as generally safe for human consumption.

FDA Action

CBD product offerings continue to rise, ranging from CBD infused pillows to suppositories. While products containing CBD have increased in popularity, the FDA has stood at a distance until recently. The result of this lack of enforced policy has led to a scenario where upwards of 70% of all CBD products available online are mislabeled (Caroon, 2018).

This lack of enforcement and flexing of authority seems to be a thing of the past, however. In late November, the FDA sent a warning letter to 15 facilities that had engaged in interstate commerce with a CBD product. These warnings stemmed largely from non-compliant claims of health benefits, CBD use as a dietary supplement, and CBD used in food products offered for sale across state lines.

Until CBD is either identified as GRAS or a specific product gets preapproval, the current issues with CBD in food will remain. In the meantime, manufacturers must be aware of their ingredients, their claims, and the ramifications these may have on the FDA jurisdiction over their products.

References

Cohen, P., & Sharfstein, J. (2019). The opportunity of CBD — reforming the law. The New England Journal of Medicine, 381(4), 297-299.

Corroon, J., & Kight, R. (2018). Regulatory status of cannabidiol in the united states: A perspective. Cannabis and Cannabinoid Research, 3(1), 190-194. doi:http://dx.doi.org.ezproxy.neu.edu/10.1089/can.2018.0030

Gururajan, A., & Malone, D. (2016). Does cannabidiol have a role in the treatment of schizophrenia? Schizophrenia Research, 176(2-3), 281-290.

O’Connor, S. and Lietzan, E. (2018). The surprising reach of FDA regulation of cannabis, even after descheduling. American University Law Review 68, 823.

Mayal, S. and Throckmorton, D. (2019). FDA Role in Regulation of Cannabis Products. Retrieved from https://www.fda.gov/media/128156/download

White, C. (2019). A Review of Human Studies Assessing Cannabidiol’s (CBD) Therapeutic Actions and Potential. Journal of Clinical Pharmacology, 59(7), 923-934.