Mergers and acquisition activity in the cannabis space tripled from 2020 to 2021, and that pace is on track to continue in 2022. With big players entering the global cannabis market, we’re fielding more questions about mergers and acquisitions of cannabis businesses.

In this guide, we look at the evolution of the U.S. cannabis industry and some best practices and considerations for M&A deals in this environment.

The New Reality of Cannabis M&A Activity

The industry has evolved since adult use cannabis was first legalized in some U.S. states in 2012. More cannabis companies have a professional infrastructure—legal, financial and operational—with executive teams and board members ensuring the organization establishes proper governance procedures. Investors and private equity firms are showing more interest, and some cannabis companies have celebrated their first IPOs on the Canadian Securities Exchange (CSE).

At the same time, we are seeing a kind of “market grab” by multistate operators (MSOs) looking to acquire various licenses and expand their market share. MSOs tend to understand the current state of the market. For example, in California and some other states, there is a surplus of cannabis on the market for various reasons, partially due to so-called “burner distribution”—rogue distributors using licenses to buy vast amounts of legally grown cannabis at wholesale prices and selling the product on the black market, thereby undercutting retailers and other legal cannabis businesses. Another reason for the surplus is simply the entrance of many legal cultivators into the market over the past year.

Due to these trends, MSOs are interested in acquiring the outlets to be able to sell the surplus cannabis within California and other new markets.

Transferring Cannabis License Rights

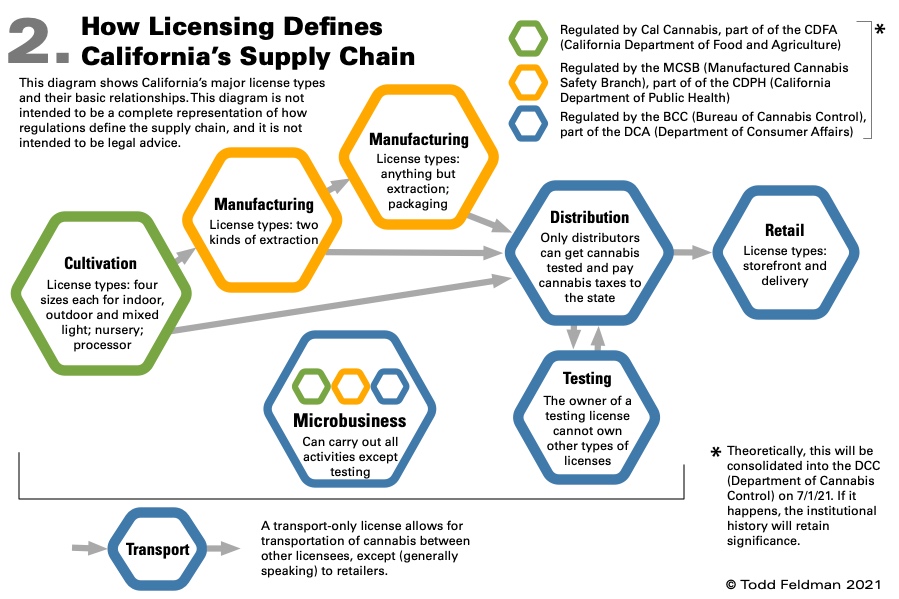

One of the biggest challenges to M&A activity in the cannabis sector is the difficulty of transferring or selling a cannabis license.

Cannabis licenses are not expressly transferable or assignable under California law and many other states. However, the parties involved aren’t without options. For example, a business that is sold to a new owner may be able to retain its existing cannabis license while the new owner’s license application is pending, as long as at least one existing owner is staying on board. At the state license level, a change of up to 20% financial interest does not constitute a change in ownership, although the Bureau of Cannabis Control (BCC) must be notified and approve the change.

This process can take a while—often a year or more—since licensing involves overcoming hurdles at the local level as well as the state level with the BCC. It’s crucial to talk with legal counsel about the particulars of the license and location early in the process to best structure the terms of the agreement while complying with state and local requirements.

Seeking a Tax-Free Reorganization in the Cannabis Space

In many cannabis mergers and acquisitions, the goal is to accomplish a tax-free reorganization, where the parties involved acquire or dispose of the assets of a business without generating the income tax consequences that would result from a straight sale or purchase of those assets.

IRC Section 368(a) defines various types of tax-free reorganizations, including:

Stock-for-stock exchanges (IRC Section 368(a)(1)(B)

In a stock-for-stock reorganization, all of the target company’s stock is traded for a portion of the stock of the acquiring parent corporation, and target company shareholders become minority shareholders of the acquiring company.

Often, it’s tough to meet the requirements to qualify for this type of tax-free reorganization because at least 80% of the target stock must be paid for in voting stock of the acquirer.

Often, it’s tough to meet the requirements to qualify for this type of tax-free reorganization because at least 80% of the target stock must be paid for in voting stock of the acquirer.

Additionally, companies may be saddled with too much debt. If the acquirer assumes that debt, it may be classified as consideration paid to the seller and therefore disqualify the transaction as a tax-free reorganization.

In other M&A deals, the acquiring corporation may be unwilling to assume the debt of the target corporation—perhaps because showing these items on its balance sheet would impact its debt-to-equity and other financial ratios.

Stock-for-asset exchanges (IRC Section 368(a)(1)(C)

Rather than acquiring the target company’s stock, the acquirer may purchase its assets. In a stock-for assets exchange, the buyer must purchase “substantially all” of the target’s assets in exchange for voting stock of the acquiring corporation.

A stock-for-assets format offers the buyer the benefit of not having to assume the unknown or contingent liabilities of the target. However, it’s only feasible if the acquirer purchases at least 80% of the fair market value of the target’s assets AND all or virtually all of the deal consideration will be stock of the acquirer.

Tax Consequences Arising from Sale of Assets

If the sale price doesn’t consist primarily of the buyer’s stock, the transaction may be a standard asset sale. This leads to very different tax results.

If the seller is a C corporation, it will typically face double taxation—paying tax once on the sale of assets within the corporation and again when those profits are distributed to shareholders. If the target company has net operating losses (NOLs), it can use those NOLs to offset the tax hit.

If the seller is a C corporation, it will typically face double taxation—paying tax once on the sale of assets within the corporation and again when those profits are distributed to shareholders. If the target company has net operating losses (NOLs), it can use those NOLs to offset the tax hit.

If the seller is an S corporation, it won’t have to pay corporate tax on the transaction at the federal level. Instead, shareholders will pay tax on the gain on their individual returns.

For the buyer, the benefit of an asset sale is that the assets acquired get a “step-up basis” to their purchase price. This is beneficial from a tax perspective, as the buyer can depreciate the assets and may be able to claim accelerated or bonus depreciation to help offset acquisition costs.

Reverse Triangular Merger

Often, in practice, we come across what is termed as a reverse triangular reorganization. In this type of merger,

- The acquiring company creates a subsidiary,

- The subsidiary merges into the target company before liquidating,

- The target company then becomes a subsidiary of the acquirer, and

- The target company’s shareholders receive cash.

Structuring the deal this way may work to overcome the hurdle of transferring the license but may not qualify as a tax-free reorganization.

Bottom Line

The circumstances and motivations for mergers and acquisitions in the cannabis industry are diverse. As a result, there is no one-size-fits-all approach to structuring the transaction. In any event, it’s crucial to start the process early and seek advice from legal counsel and tax advisors to minimize the tax burden and ensure that both parties to the transaction get the best deal possible. If you need assistance, contact your 420CPA strategic financial advisor.