Aurora has just faced a rare setback in Europe. The Italian government has cancelled one of three tender cultivation lots to supply Italian patients it granted Aurora this summer (in July).

Aurora was the only company to win the bid after other companies were disqualified.

For this reason, the high-level parliamentary attention to the bid this fall is even more interesting. Most foreign cannabis is being imported from the Netherlands and Bedrocan. While Wayland (ICC) and Canopy are in the country (Wayland has established production facilities for CBD in fact), Aurora was the only foreign Canadian cannabis company to actually win government issued, cultivation slots.

What Is Going On?

In July, Aurora won the Italian bid, beating out all other companies for all three lots.

Yet in September, the third lot, for high-level CBD medical flower, was cancelled by the Ministry of Defense which oversees cannabis importing and production, for an odd reason. Specifically, the lot was suddenly “not needed.”

Yet in September, the third lot, for high-level CBD medical flower, was cancelled by the Ministry of Defense which oversees cannabis importing and production, for an odd reason. Specifically, the lot was suddenly “not needed.”

As of October 31, the Minister of Health responded to parliamentarians who wondered about this administrative overrule by saying that the rejected lot (lot 3, for high-level CBD) was in fact rejected because stability studies to define the shelf life of products were not being conducted.

EU GMP Standards Are In The Room In Europe

This is not really a strange turn of events for those who have been struggling on the ground in ex-im Europe to learn the rules.

For at least the second time this year, and possibly the third, a national European government has called stability tests and the equality of EU-GMP standards into question. As Cannabis Industry Journal broke earlier this fall, the Polish government apparently called the Dutch government into question over stabilization tests (albeit for THC imports) during the February to September timeframe.

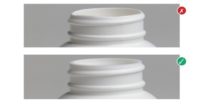

It is still unknown if there is any connection between these two events although the timing is certainly interesting. Just as it was also interesting that both Denmark and Holland also seemed to be in sync this summer over packaging and testing issues in July.

It is still unknown if there is any connection between these two events although the timing is certainly interesting. Just as it was also interesting that both Denmark and Holland also seemed to be in sync this summer over packaging and testing issues in July.

Aurora and Bedrocan are also the two biggest players in the Polish market (although Canopy Growth as well as other international, non-Canadian cannabis companies are also making their mark).

What is surprising, in other words, is that countries all around Germany are suddenly asking questions about stability tests, but German authorities, still are notably silent.

Why might this be? Especially with German production now underway, and imports surging into the market?

Is This A Strange EU-Level CBD Recreational Play In Disguise?

There are no real answers and no company is talking – but in truth this is not a failure of any company on the ground, rather governments who set the rules. If there are any cannabis companies in the room at this point who are not in the process of mandating compliance checks including stability tests, it is the governments so far, who have let this stand.

Notably, the German government. Nobody else, it appears, is willing to play this game.

Further however, and even more interestingly, this “cancellation” also comes at a time when novel food is very much in the room in Italy. Namely, it is now a crime to produce any hemp food product without a license. There is no reason, in this environment, why a national cultivator could not also produce locally a high-quality, high-CBD product for the nascent Italian medical market.

While nobody is really clear about the details, there is one more intriguing detail in the room. The government may, in fact, allow medical cultivation now by third parties.