Calls for more testing have been a watchword of both cannabis reform advocates and opponents alike for many years.

However, now is a really good time for cannabis companies to consider sponsoring medical trials across Europe for their cannabis products. This is why:

The Current Environment On The Ground

Germany is Europe’s biggest consumer of both prescription medications and medical devices dispensed by prescription. It is, as a result, Europe’s most valuable drug market. And ground zero for every international cannabis company right now as a result.Targeting Germany for your latest pharmaceutical product is difficult no matter who you are.

Here, however, are a few problems that face every pharma manufacturer, far beyond cannabis. Targeting Germany for your latest pharmaceutical product is difficult no matter who you are.

- The vast majority by euro spending on all drugs and devices dispensed by prescription must be pre-approved. To add to this problem, before they can be prescribed, new drugs must get on the radar of doctors somehow. To put this in stark relief, the entire prescription drug and medical device annual spend is about 120 billion euros a year in Germany. Only 20 billion euros of that, however, may be obtained relatively easily (without pre-approval from an insurer). Preapproval also only comes when there is trialor other scientific evidence of efficacy.

- There are strict rules banning the advertising of prescription drugs to patients and highly limiting this outreach to doctors.

- There are strict rules prohibiting the use of the word “cannabis” to promote anything.

- There is a strong reliance on what is called “evidence-based medicine.” That means that large numbers of doctors and insurance company approvers need to see hard data that this drug or device actually works better than what is currently on the market.

How then, is a new drug supposed to get on the radar of those who prescribe the drug? Or patients?

If this sounds like an impossible situation to navigate, do not despair. There is a way out.

The Impact of the European Medicines Agency

This agency has been much in the news of late. Namely, the British do not want to exclude themselves from the regulatory umbrella of this organization.

Largely unknown outside Europe, this agency actually has a hugeinfluence on how drugs are brought into the region. Specifically, this is the EU-wide agency (aka the EMA) that both regulates all drugs within Europe, but has also, since 2016, been making clinical reports submitted by pharmaceutical companies, available to anyone who asks for them. That includes doctors, members of the public and of course, the industry itself.

In the middle of July, the agency also published a report on the success of its now three-year-old program, including the usage of its entry website. Conveniently written in English, it is possible to easily search new trial data, which, also now must be made public.

Medical trial data, in other words, that can be created by sponsored cannabis company backed trials.

It remains the best way to get patients, doctors and insurance companies familiar with new drugs. Or even new uses for old drugs in the case of cannabis.

Will Trials Move Legalization Discussions?

Of all the established cannabis companies now in operations with producton the ground, GW Pharmaceuticals has learned that this strategy can actually cut both ways.

However,there are no other cannabis companies in the position of GW Pharma – namely with a monopoly on a whole country (the UK), where it alone can legally grow cannabis crops and process the same into medication and further for very profitable export. In addition, even more disturbingly, and clearly an era that is coming to an end, the vast majority of British patients have been excluded from access to cannabis except in the case of GW Pharma products.

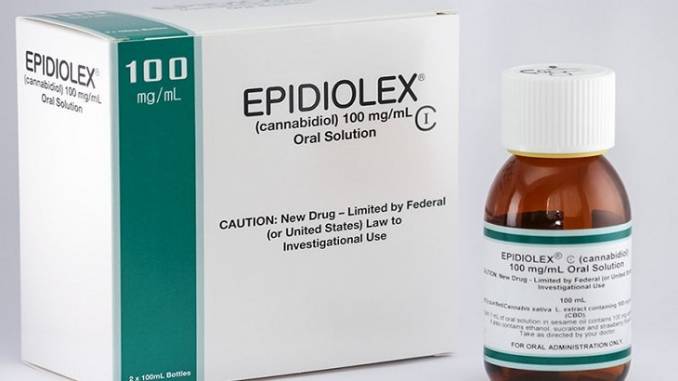

The current row over expanded medical use in the UK, in fact, was triggered by two things. The failure of the latest GW Pharma trial for drug resistant epilepsy in Eastern Europe. And the deliberate importation by several desperate families, of good old cannabis (CBD) oil into the UK. No medical processing required.

However, that is the UK.

Other cannabis companies can take a page out of the company’s handbook. All that is required for faster market entry, is a slightly altered recipe.

By sponsoring cannabis-related trials in each country they want to enter, starting with Germany, cannabis companies can literally put themselves on the medical map.

Why?

Because doctors, patients andother researchers will be easily able to see and access country-specific medical data on each use of cannabis covered by a trial, per EU country. All made possible, of course, by the new open door policy of the EMA.

Growing the Medical Market

While this may sound like an “expensive” proposition, there are really few other alternatives. And with no advertising budget, plus a marketing budget that must include outreach to everyone in the supply chain including doctors, distributors and even pharmacies, the trial approach in the end may be the most efficacious in broadening both the demand and market. Not to mention the cheaper option.

How such a trial strategy might be coordinated at a time when domestic cultivation is still on hold is still a question. However for those companies considering market entry and cultivation bid if not domestic processing strategies for their products is an industry strategy that will pay off in spades.

Its role in the legalization of cannabis as medicine, as well as the speedier introduction of new drugs overall into the European system,cannot be underestimated, even if it is currently underutilized by the cannabis industry specifically now.