As Europe swooned under record-breaking heat this summer, the cannabis industry also found itself in a rather existential hot seat.

The complete meltdown at CannTrust has yet to reach a conclusion. Yes, a few jobs have been lost. However, a greater question is in the room as criminal investigatory and financial regulatory agencies on both sides of the US-Canada border (plus in Europe) are getting involved.

As events have shown, there is a great, big, green elephant in the room that is now commanding attention. Beyond CannTrust, how widespread were these problematic practices? And who so far has watched, participated, if not profited, and so far, said nothing?

Who, What, Where?

The first name in the room? Canopy Growth.

Why the immediate association? Bruce Linton, according to news reports, was fired as CEO by his board the same day, July 3, 2019, that CannTrust received its first cease and desist notice from Health Canada.

Further, there is a remarkable similarity in not only problematic practices, but timing between the two companies. This may also indicate that Canopy’s board believed that Linton’s behaviour was uncomfortably close to executive misdeeds at CannTrust. Not to mention, this was not the first scandal that Linton had been anywhere close to around acquisition time. See the Mettrum pesticide debacle, that also broke right around the time Canopy purchased the company in late 2016 as well as the purchase of MedCann GmbH in Germany.

Reorg also appears to be underway in Europe as well. As of August, Paul Steckler has been brought in as “Managing Director Europe” and is now based in Frankfurt. Given the company’s history of “co-ceo’ing” Linton out the door, is more change to come?

What Went Down At Canopy?

Last year, Canopy announced its listing on the NYSE in May. To put this in context, this was two months after the first German cultivation bid went down to legal challenge. By August 15, 2018 with a new bid in the offing, the company had closed the second of its multi-billion dollar investments from Constellation.

Photo: Youtube, TSX

Yet by late October, after Bruce Linton skipped a public markets conference in Frankfurt where many of the leading Canadian cannabis company execs showed up to lobby Jens Spahn (the health minister of Germany) about the bid if not matters relating to the Deutsche Börse, there were two ugly rumours afoot.

Video showing dead plants at Canopy’s BC facility surfaced. Worse, according to the chatter online at least, this was the second “crop failure” at the facility in British Columbia. Even more apparently damning? This all occurred during the same time period that the second round of lawsuits against the reconstituted German cultivation bid surfaced.

Canopy in turn issued a statement that this destruction was not caused by company incompetence but rather a delay in licensing procedures from Health Canada. Despite lingering questions of course, about why a company would even start cultivation in an unlicensed space, not once but apparently twice. And further, what was the real impact of the destruction on the company’s bottom line?

Seen within the context of other events, it certainly poses an interesting question, particularly, in hindsight.

Canopy, which made the finals in the first German cultivation bid, was dropped in the second round – and further, apparently right as the news hit about the BC facility. Further, no matter the real reason behind the same, Canopy clearly had an issue with accounting for crops right as Canadian recreational reform was coming online and right as the second German cultivation bid was delayed by further legal action last fall.

Has Nobody Seen This Coming?

In this case, the answer is that many people have seen the writing on the wall for some time. At least in Germany, the response in general has been caution. To put this in true international perspective, these events occurred against a backdrop of the first increase in product over the border with Holland via a first-of-its kind agreement between the German health ministry and Dutch authorities. Followed just before the CannTrust scandal hit, with the announcement that the amount would be raised a second time.

German health authorities, at least, seem doubtful that Canadian companies can provide enough regulated product. Even by import. The Deutsche Börse has put the entire public Canadian and American cannabis sector under special watch since last summer.

Common Territories

By the turn of 2019, Canopy had announced its expansion into the UK (after entering the Danish market itself early last year) and New York state.

And of course by April, the company unveiled plans to buy Acreage in the U.S.

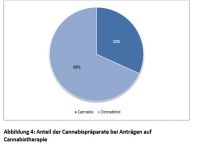

Yet less than two weeks later, Canopy announced not new cultivation facilities in Europe, but plans to buy Bionorica, the established German manufacturer of dronabinol – the widely despised (at least by those who have only this option) synthetic that is in fact, prescribed to two thirds of Germany’s roughly 50,000 cannabis patients.

By August 2019, right after the Canopy Acreage deal was approved by shareholders, Canopy announced it had lost just over $1 billion in the last three months.

Or, to put this in perspective, 20% of the total investment from Constellation about one year ago.

What Happened At CannTrust And How Do Events Line Up?

The current scandal is not the first at CannTrust either. In November 2017, CannTrust was warned by Health Canada for changing its process for creating cannabis oil without submitting the required paperwork. By March of last year however, the company was able to successfully list on the Toronto stock exchange.

Peter Aceto arrived at CannTrust as the new CEO on October 1 last year along with new board member John Kaken at the end of the month. Several days later the company also announced that it too, like other major cannabis companies including Canopy, was talking to “beverage companies.” It was around this time that illegal growing at CannTrust apparently commenced. Six weeks later, the company announces its intent to also list on the NYSE. Two days later, both the CEO and chair of the board were notified of the grow and chose not to stop it.

Peter Aceto arrived at CannTrust as the new CEO on October 1 last year along with new board member John Kaken at the end of the month. Several days later the company also announced that it too, like other major cannabis companies including Canopy, was talking to “beverage companies.” It was around this time that illegal growing at CannTrust apparently commenced. Six weeks later, the company announces its intent to also list on the NYSE. Two days later, both the CEO and chair of the board were notified of the grow and chose not to stop it.

Apparently, their decision was even unchanged after the video and resulting online outrage about the same over the destroyed crops at the Canopy facility in BC surfaced online.

On May 10, just over a week after the Bioronica purchase in Germany, the first inklings of a scandal began to hit CannTrust in Canada. A whisteblower inside the company quit after sending a mass email to all employees about his concerns. Four days later, the company announced the successful completion of their next round of financing, and further that they had raised 25.5 million more than they hoped.

Six weeks later, on June 14, Health Canada received its warning about discrepancies at CannTrust. The question is, why did it take so long?

Where Does This Get Interesting?

The strange thing about the comparisons between CannTrust and Canopy, beyond similarities of specific events and failings, is of course their timing. That also seems to have been apparent at least to board members at Canopy – if not a cause for alarm amongst shareholders themselves. One week after Health Canada received its complaint about CannTrust, shareholders voted to approve the Canopy-Acreage merger, on June 21.

Yet eight days after that, as Health Canada issued an order to cease distribution to CannTrust, the Canopy board fired Bruce Linton.

Yet eight days after that, as Health Canada issued an order to cease distribution to CannTrust, the Canopy board fired Bruce Linton.

One week after that, the Danish recipient of CannTrust’s product, also announced that they were halting distribution in Europe. By the end of August, Danish authorities were raising alarms about yet another problem – namely that they do not trust CannTrust’s assurances about delivery of pesticide-free product.

Is this coincidence or something else?

If like Danish authorities did in late August 2019, calling for a systematic overhaul of their own budding cannabis ecosystem (where both Canadian companies operate), the patterns and similarities here may prove more than that. Sit tight for at least a fall of more questions, if not investigations.

Beyond one giant cannabis conspiracy theory, in other words, the problems, behaviour and response of top executives at some of the largest companies in the business appear to be generating widespread calls – from not only regulators, but from whistle blowers and management from within the industry itself – for some serious, regulatory and even internal company overhauls. Internationally.

And further on a fairly existential basis.

EDITOR’S NOTE: CIJ reached out to Canopy Growth’s European HQ for comment by email. None was returned.

Correction: This article has been updated to show that the Danish recipient of Canntrust’s product announced they were halting distribution one week after Bruce Linton’s firing, not one day.