2019 opened with a strange vibe in the air on the cannabis front. Israel and Thailand set the stage with dramatic reform announcements last Christmas. And as the calendar counts down to 2020, the larger players all seem to be licking their wounds (if not stock prices).

But cannabis reform is not just about profits on the public markets. What has gone down and where and ultimately, has the year lived up to its promise?

Reform Marched On In Several Countries

At this point, reform is certainly “too big to fail.” There will be no going back anywhere no matter the laggards still in the room.

From the perspective of opening patient access (and markets beyond that), There were several big stories on the medical front this year – and – in a real first for the EU – of not only the medical, but recreational kind as well.

Germany of course is going, relatively speaking, like “gangbusters” on the medical front although supply, quality and supply chain issues are still in the room. Even more so now because the German government has also announced, for the first time, a public reference wholesale price per gram of floss. That alone is big news, although expect that too to drop (see Aurora’s pricing for Italy, for starters).

In the UK, the NHS finally got down to brass tacks and negotiated a bulk discount for GW Pharmaceuticals cannabis drugs for a very narrow band of patients (mostly child epileptics and MS patients). A tiny minority of the estimated 1.4 million daily British “medical” users including those suffering from chronic pain can afford imports. The rest is all black, or in the case of CBD, gray market.

In France, the country finally got on the reform bandwagon with a “medical trial.” This means that all the major countries in the region are finally on board with some kind of reform. That too is a meaningful move.

Poland is also opening – a good sign for the remaining conservative countries in Europe still on the fence.

Poland is also opening – a good sign for the remaining conservative countries in Europe still on the fence.

And in a real first (although do not get too excited just yet), on the “recreational” front, it is not just Holland that is in the room any more. Both Denmark and Luxembourg announced that they were opening this conversation. In Denmark and Holland’s case, this is in the form of “trials” in places where operational grey markets have already been established. In Holland, this is of course, regulating the “coffee shop” trade in large cities like Amsterdam. In Denmark, the new “trial” will be on the grounds of a revived hippy experiment called Christiana, that morphed predictably into the control of gangs over the last generation.

Luxembourg, however, seems intent on setting the benchmark if not timeline and is moving aggressively in one direction. As a result, as of this year, the strategic “heart” of Europe is now on the schedule to go full monty by 2022. That said, it is a country of about half a million people. Further, no matter the inevitably hype on the way, don’t expect the country to turn into a big cannabis hub- nor encourage pot tourism even from neighboring Europeans.

The end of 2021 is the time to watch for all things recreational. In the meantime, including next year, look for increasing “experiments” in other places. Particularly of the Swiss variety (where both recreational and medical products are sold via pharmacies.)

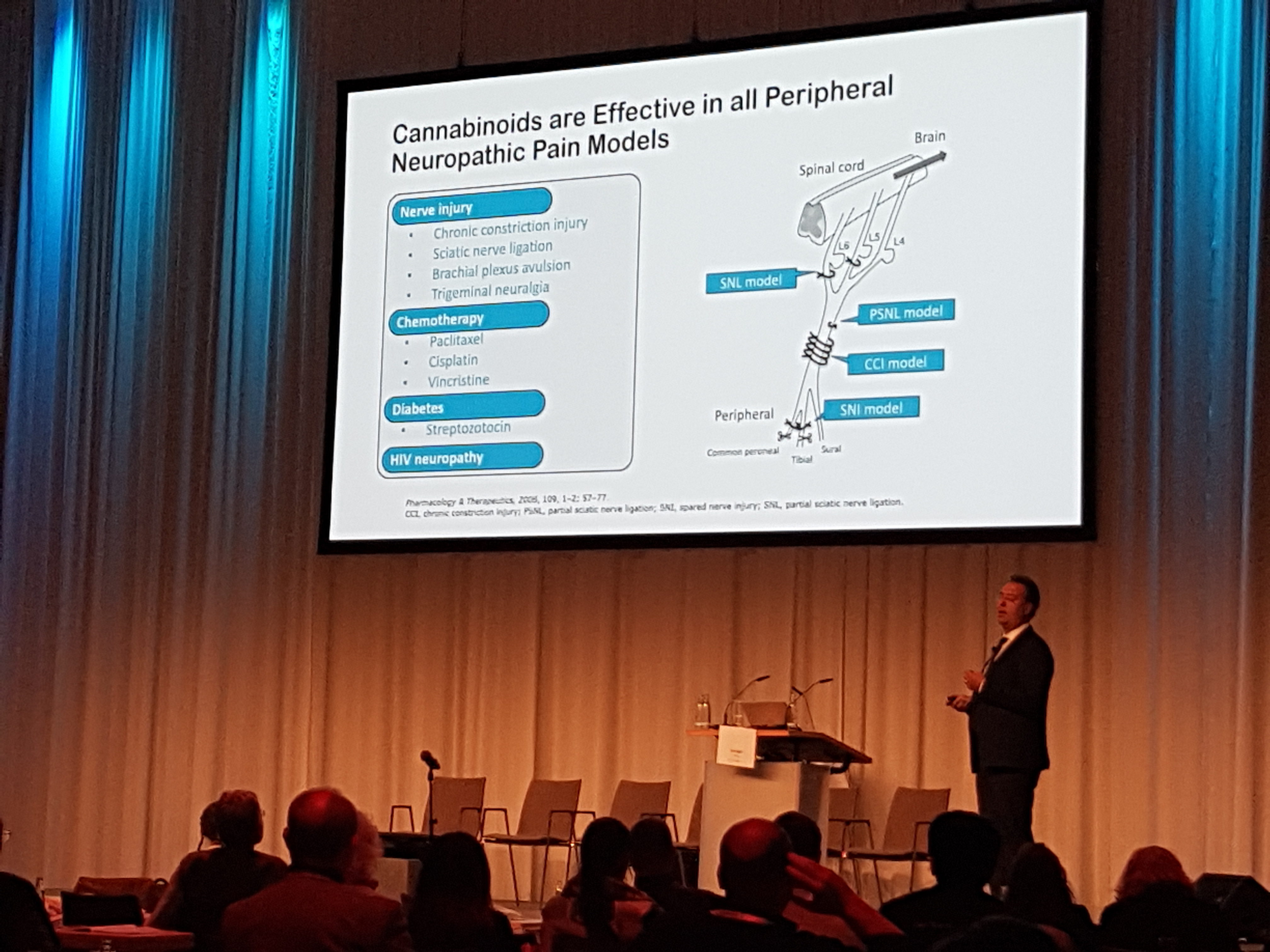

THC Is Being Accepted As Having Medical Efficacy

No matter the controversy in the room, and the strange inclinations of the British NICE to try to undo forty years of medical knowledge about the impact of THC on chronic pain, medical cannabis and specifically medical cannabis with THC has made its global medical debut as of this year.

That said, the push is on to “pharmacize” the product.

That said, the push is on to “pharmacize” the product.

Flower (floss) is in the room, in other words, but the future is looking towards oils and distillates – at least for the medical market long term. And a lot of that will also come increasingly to this market from places like Portugal, Spain, Greece and other European markets now moving into the cultivation space seriously.

Then again, there is still a lot of road to travel. Wags who predicted that German health insurers would never pay for floss cannabis just five years ago were wrong.

CBD Is Not All Its Cracked Up To Be

For all those who sang “Free the CBD” this year, Europe has taken a rather conservative and concerted push back. From Austria to Italy and Sweden to Poland, the path to market for any product containing CBD has been a tough one this year.

That said, perhaps it is a call for more standardization- no matter how painful that might be economically. At a presentation given at this year’s IACM medical conference in Berlin, a medical researcher revealed the results of a study he had conducted on the accuracy of labelling of these products in several European countries. The industry has not standardized, labelling is all over the place in terms of accuracy – and the claims about “medical efficacy” are hard to swallow for substandard over-the-counter product.

If the CBD-based part of the industry is to thrive here, it will have to find a way to establish and certify itself. That appears to be going on in Italy right now. It also impacts every cultivator from Portugal and Spain to Eastern Europe looking at the possibilities right now.

However, with labelling and other EU cross currents in the room, this route to the industry has been fraught this year with all the cross winds and those are not likely to dissipate next year or indeed for the next several.

The Cannabis Winds Of Trade Are In The Air

While it may be a bit ironic, given that international trade has pretty much always been a hallmark of the development of the modern cannabis industry, next year will undoubtedly be the year of “International Cannabis Trade.”

No matter the problems “back home,” as of this year, a German-based manufacturer of GMP-certified product got fully underway (see ICC/Wayland’s success this year). That, along with the final decision on the first German cultivation bid, has clearly shaped a market that is still changing. And that change is driven by the admission, even by authorities, that there is not enough legal cannabis grown in the country.

No matter the problems “back home,” as of this year, a German-based manufacturer of GMP-certified product got fully underway (see ICC/Wayland’s success this year). That, along with the final decision on the first German cultivation bid, has clearly shaped a market that is still changing. And that change is driven by the admission, even by authorities, that there is not enough legal cannabis grown in the country.

That means that the strength of the German market will continue to drive policy (see the recent announcements on wholesale pricing) as well as demand that will be met across the continent.

Along the way, cannabis reform is also being driven locally. And that means, no matter the trials and tribulations of the Canadian part of the sector, which perhaps can be considered aptly warned for getting a bit too big for its britches, and no matter how faulting, the winds of reform are still afloat. Just perhaps, on the cards for next year and those to come, blowing from many more points on the globe.