Over the past century, numerous pivotal concepts have emerged, shaping the course of society and enhancing our collective well-being. Among these, Good Manufacturing Practices (GMPs) stand out as a beacon of assurance for product safety and consumer protection. Prior to the establishment of GMPs, industries such as pharmaceuticals operated in a murky landscape where products were peddled from wheeled carts as “miracle elixirs,” often containing undisclosed and potentially harmful ingredients. Labeling requirements were lax, production methods were shrouded in mystery, side effects were unknown, and the true efficacy of these concoctions was questioned.

Here in the United States, because of a previous lack of GMPs, there have been several major incidents over the years which have had catastrophic consequences. Poor controls for safety in the production of food, pharmaceuticals, supplements, medical devices, and more resulted in thousands of deaths and/or other medical issues. In 1938, three decades after the Pure Drug Act, Congress passed the Federal Food, Drug, and Cosmetic Act (FDCA), which formally established the FDAs authority to protect public health.

Take ‘snake oil’ for instance, a term evoking deceptive practices or fraudulent schemes. The original Chinese concoction was made using the oil from Chinese Water Snakes which helped relieve sore muscles and inflammation. When American salesmen got ahold of the recipe, they attempted to use rattlesnake oil, which does not have the same properties as the Chinese Water Snake. By the time the recipe was tested, it was shown to contain alcohol and opium, but no real snake oil. This illustrates the dangers of unregulated products and the importance of standards like GMPs in ensuring product integrity and consumer safety. Without proper oversight, consumers are vulnerable to misleading claims and potentially harmful substances, underscoring the necessity of stringent manufacturing practices in all industries, including cannabis.

In reviewing several examples in history where tragedies resulted, we can go back as far as 1906 when tainted and misbranded food and drugs led to widespread illness and death until basic standards were established for product safety and labeling. Speaking of the turn of the century, if you haven’t read “The Jungle” by Upton Sinclair, put it on your reading list. It is one of the most influential books in American history, as it details the unsanitary conditions of the meat industry before GMPs and is directly responsible for Congress passing some of the first food safety laws.

Some of you may be old enough to remember back in 1982 when seven people died after ingesting cyanide-laced Tylenol capsules. This led to the introduction of new industry standards, including tamper-evident packaging and heightened safety measures for over-the-counter medications.

Even in modern times, recalls of contaminated meats and produce serve as stark reminders of the ongoing importance of stringent safety measures. These recalled food products not only pose serious health risks but also incur significant financial losses and damage to the brand reputation of the companies involved. To further underscore the importance of these safety measures, in 1994 Congress authorized the FDA to implement GMP guidelines for dietary supplements through DSHEA (Dietary Supplement Health and Education Act). However, GMP guidance for dietary supplements was not released until 2007.

“There are a lot of examples where failure to implement GMPs creates safety problems. Many food recalls and FDA warning letters report problems with pest control, worker sanitation, cleaning and sanitation, employee practices, and other GMPs,” says Steve Gendel, Ph.D., an expert on food safety and consultant at The GMP Collective. (Gendel also serves as the Technical Contact for the cannabis GMP standard that was recently balloted at ASTM.) “One example of the problems caused by inadequate GMPs is the recent announcement that Family Dollar Stores pleaded guilty to a federal felony and must pay a $41 million fine for failure to control rodents in a warehouse. This follows a massive recall of hundreds of products that passed through that warehouse.”

In addition to criminal liability and hefty fines, a brand that fails to maintain the standard levels of safety and sanitation is not posing risks to customers and employees alike; it can also suffer long-term damage to reputation in the public eye, creating a public relations nightmare. In a blog by Rootwurks in August 2023 titled “It’s All About The Consumer,” Dr. Kathy Knutson, another food safety expert and consultant at The GMP Collective, states, “There can be brand damage through consumer litigation if any harm is caused. There can be regulatory action including fines and recalls. In the food industry, the average cost of a recall is $10 million.” For cannabis products, the most common types of recalls involve contamination of products containing Aspergillus, Salmonella, mold, heavy metals, and certain pesticides.

The cannabis industry, once relegated to the shadows of illegality, is now emerging into a legitimate marketplace. However, as it gains momentum, it faces numerous challenges, including the imperative of ensuring product safety, consistency, and regulatory compliance. Adopting and adhering to GMPs will be essential for the industry to establish marketplace trust, safeguard consumer health, and thrive in a competitive landscape. “The California Cannabis Commission lists 13 recalls for cannabis products from January 2022 through February 2024. Of these, nine were related to problems that could have been controlled by GMPs and/or good cultivation practices,” added Gendel.

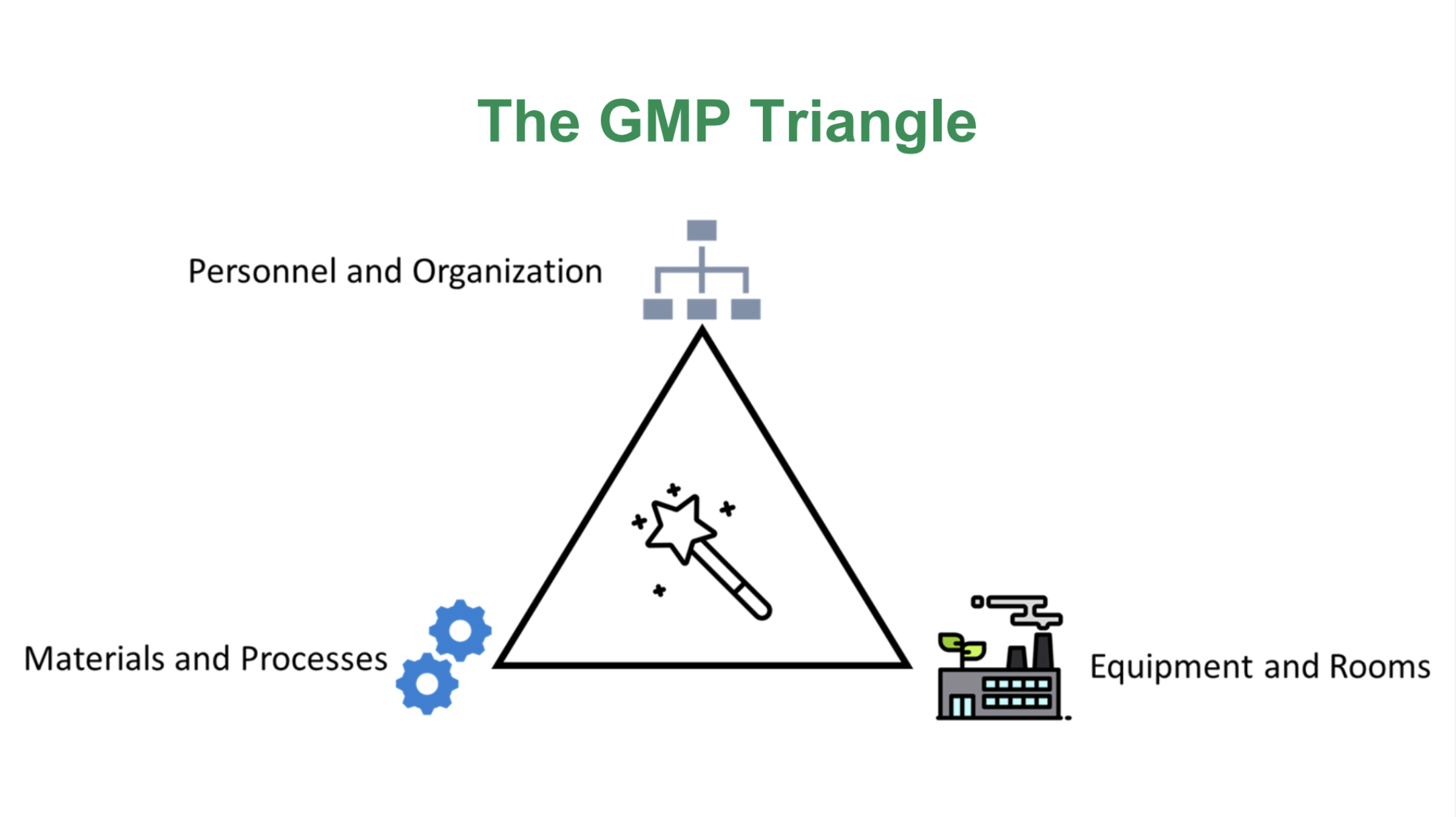

Today, while there is no national requirement for Good Manufacturing Practices in the cannabis industry, over a dozen states currently require some form of GMP for cannabis operators — and for good reason. When implemented effectively, GMPs are good for businesses and good for consumers. They reduce the risk of costly product failures and recalls. They provide employees with the tools and guidance needed to carry out their duties — safely and efficiently. Whether it is preventing mold and pests through effective sanitation programs or verifying that equipment purchased works as intended, day in and day out GMPs truly are simply Good Practices and the absolute bare minimum that any business owner and consumer alike should demand of their operation.

The potential risks to human health aren’t limited to cannabis products alone. Vaporizers and other related devices represent a crucial aspect of safety to consider. As the cannabis industry transitions from illegality to legitimacy, ensuring product safety, consistency, and regulatory compliance becomes paramount. GMP adoption is crucial for establishing marketplace trust, safeguarding consumer health, and thriving in a competitive landscape.

Whether it’s the spices and herbs in your kitchen, medicines in your medicine cabinet, or the food in your refrigerator, GMPs have been recognized as the global minimum best practices that have helped our planet feed, nourish, and protect the nearly 8 billion people on our planet. In conclusion, the importance of GMPs spans all industries, safeguarding consumers and businesses alike. The cannabis industry’s embrace of GMPs signals a commitment to excellence and underscores the vital role these practices play in fostering a safe and reputable marketplace now and in the future.