After a year of embarrassing missteps and revelations, along with two well-run advocacy campaigns by the parents of children with drug-resistant epilepsy, the British government is finally throwing in the towel on medical cannabis.

Sadly, politics rather than science has driven the pace of British cannabis legalizationIn the last week of July, a mere two weeks after announcing his review of the issue against mounting domestic pressure and outrage in the media, Sajid Javid, the home secretary, announced that cannabis medications will be rescheduled by the fall, allowing doctors to prescribe them more widely.

“Fall,” it should be noted, is not only when the Canadian government moves ahead with its own fully recreational market, but also when the German bid respondents need to file their paperwork to participate in the country’s first grow bid, Round II.

A Political Embarrassment Beyond Brexit

Sadly, politics rather than science has driven the pace of British cannabis legalization, just like it has in other places. However the UK is one of the best examples of how far medical knowledge has outstripped the pace of political change, and in this case, exposed bare the banal reason.

News broke this summer, as two families mounted a highly successful battle in the public for medical access, that the Prime Minister herself has personally profited from a status quo that is only now slowly going to change.

How and why?

Image: Annika Haas, Flickr

It was bad enough in May that the publicly anti-pot reformer Victoria Atkins, the cabinet level British drugs minister, was married to the managing director of British Sugar, the company with the exclusive right to grow cannabis in the British Isles. British Sugar is also the sole cultivator for GW Pharmaceuticals, the only company with the license to produce cannabis medications in the UK (and export them globally). In June, however, it emerged that Prime Minister Theresa May’s husband, Phillip May, is employed by Capital Group– an investment firm that is also the largest shareholder in GW Pharma. This is against the backdrop of news that broke earlier this year that GW Pharma had made the UK the single largest exporter of cannabis-based medicine annually. Globally. Even more than all of the Canadian firms combined currently exporting to Europe and beyond. Even as the drug is largely denied to British residents.

You don’t even have to be British to think the entire situation is more than a bit of a sticky wicket.

Vested, If Not Blueblood Interests

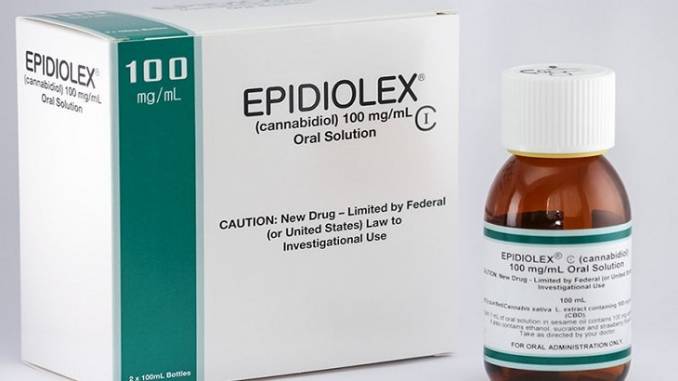

This development also came to light right as GW Pharma’s newest focal epilepsy drug faltered to failure in Eastern European trials and as Epidiolex, the company’s drug for certain kinds of childhood epilepsy, was given the green light in the U.S. by the government as the “first” cannabis-based medication to be allowed for sale in America.

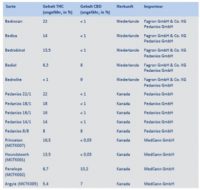

No one has yet defined exactly what kind of cannabinoids will be allowed to be prescribed in the UK come fall, but here is the most interesting development of all that still hangs over the British Isles like stale smoke: Will competitors to GW Pharma be allowed to sell their products to medical customers in the UK or will this new opening for patients just create more of a monopolized windfall for one company whose profits, at least, lie in “pharmatizing” the drug rather than creating greater access to the raw plant or its close derivatives? And those profits flow to women (and men) with the greatest political control over the development of the industry in the country.

Is This Really A “Legalization” Victory?

In the short term, no matter how limited, the answer is actually yes. Rescheduling the drug is a step that has not even been taken in the U.S., and will serve, medically, to reset the needle if not the debate about the circumstances under which cannabis should be used for patients.

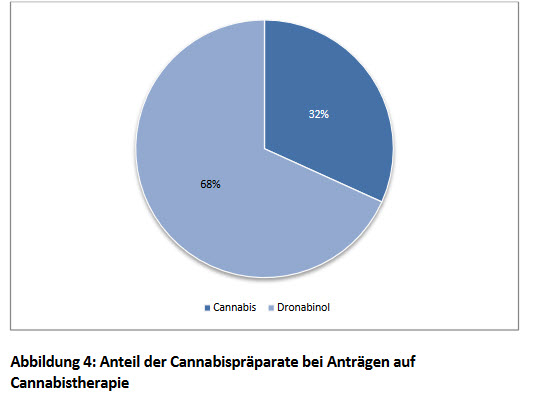

It will also move the punishment discussion in a way that still has not happened in places like Germany where, technically, the drug has not yet been decriminalized even though doctors are prescribing it and public health insurers cover the costs for increasing numbers of patients. Large numbers of Britons, just like everywhere else, are incarcerated every year or obtain black marks on their records for mere possession that in turn can affect lives.

Finally, it will put recreational reform in the room, even if still knocking at the door. This discussion too has been gaining in popularity over the past year in particular as reform moves elsewhere. Like Germans, like Canadians and like Americans, reform in Colorado and Washington set loose a global revolution, which will clearly not be stopped.

Even if in places like the UK, it is still moving far slower than it should be. For political and business reasons, not driven by science.