Part 1 of this series discussed the lack of bankruptcy protections for cannabis companies, since bankruptcy in the U.S. is an exclusively federal procedure and cannabis remains illegal under federal law and proposed a number of alternative options for businesses struggling in the current environment. Part 2 of this series focused on state law receiverships for several states.

In this the third and final part of this series, we continue to review state law receiverships for several additional states and discuss the final non-bankruptcy option for cannabis companies, an assignment for the benefit of creditors.

Below is an overview of the laws and rules governing receiverships in several additional states which have legalized cannabis.

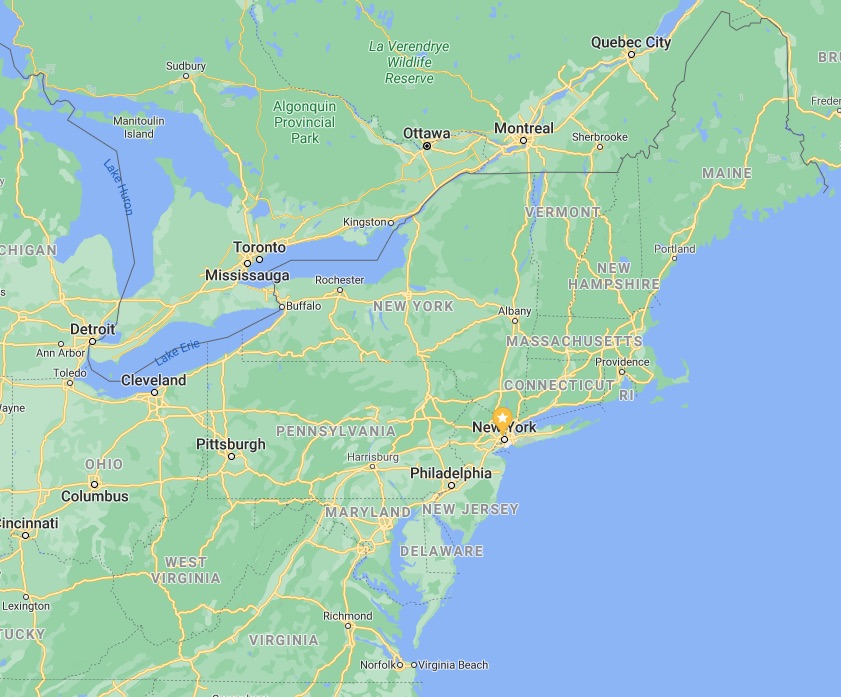

Massachusetts

In Massachusetts, receiverships are governed by statute, with numerous statutes for receivership in various industries and entity types but, in general, the appointment of a receiver is granted by a court after the filing of a complaint by third party, most frequently a secured creditor.

In keeping with its industry specific approach, the state cannabis regulator has enacted rules detailing the steps for a cannabis receivership. Most notable among these rules is a requirement to provide notice to the state regulator at least five days before filing a petition to appoint a receiver and, similar to the approach of Nevada, establishing minimum requirements for a person to serve as a receiver for a cannabis company (which generally require a person to pass a background check and have a crime-free past). In addition, because of the fairly restrictive local licensing in Massachusetts, coordination with the locality in which a cannabis company has operations is also required.

In keeping with its industry specific approach, the state cannabis regulator has enacted rules detailing the steps for a cannabis receivership. Most notable among these rules is a requirement to provide notice to the state regulator at least five days before filing a petition to appoint a receiver and, similar to the approach of Nevada, establishing minimum requirements for a person to serve as a receiver for a cannabis company (which generally require a person to pass a background check and have a crime-free past). In addition, because of the fairly restrictive local licensing in Massachusetts, coordination with the locality in which a cannabis company has operations is also required.

Michigan

Michigan has a broad receivership statute, in addition to both entity and industry specific statutes. The general receivership statute allows for the appointment of receivers as part of a court’s equitable powers so long as the appointment is permitted by law. In 2020, Michigan law was amended to specifically permit receivers to be appointed over cannabis companies. The state cannabis regulator’s rules require notice to such agency within 10 days following the appointment of a receiver, and Michigan law further provides that receivers may only operate a cannabis facility upon approval by the state regulator.

Anyone may seek the appointment of a receiver in Michigan, even if they have a connection to the property or business to be placed in the receivership. However, an action may not be brought solely to appoint a receiver but must instead be sought after an action for another claim has already been made. If a court determines it has cause to appoint a receiver, such receiver must have “sufficient competence, qualifications, and experience to administer the receivership estate”. Receivers in Michigan appointed under the general commercial receivership statute (including receivers over cannabis companies) are subject to the court’s equitable discretion but have broad powers, including the power to operate, restructure, liquidate, and sell the business.

Anyone may seek the appointment of a receiver in Michigan, even if they have a connection to the property or business to be placed in the receivership. However, an action may not be brought solely to appoint a receiver but must instead be sought after an action for another claim has already been made. If a court determines it has cause to appoint a receiver, such receiver must have “sufficient competence, qualifications, and experience to administer the receivership estate”. Receivers in Michigan appointed under the general commercial receivership statute (including receivers over cannabis companies) are subject to the court’s equitable discretion but have broad powers, including the power to operate, restructure, liquidate, and sell the business.

Missouri

Like Michigan, Missouri has a general receivership statute as well as statutes for specific receivership situations, notably with respect to corporations. However, Missouri has not enacted any particular rules with respect to cannabis companies and as a result receiverships in Missouri have been conducted under the general receivership statute.

Receivers in Missouri are appointed by a court order following the application of a person with an interest in the assets over which the receivership is sought and an appointment may be made prior to any judgement having been rendered. In addition, the appointment of a receiver may be sought as an independent claim and not as an ancillary claim to another primary claim. Receivers may be granted powers as a general receiver (similar to “equity receivers” in other states) with powers over all of the assets of a debtor, or over specific property of a debtor.

Missouri’s cannabis regulations contain very few rules that specifically relate to a receivership, other than a requirement to provide notice to the state cannabis regulator within 5 days of a receivership filing. While some parties have cited a lack of cannabis specific rules as creating a lack of clarity regarding receivership in these states, Missouri courts and the state regulator appear to be applying the general receivership rules to the industry with at least one receivership in the state in the final stages of completion.

Assignments for the Benefit of Creditors

To conclude this series, we want to revisit another option we discussed in Part 1 for dealing with a financially troubled firm: an assignment for the benefit of creditors (ABC). While voluntary negotiations with creditors is typically taken where the value of the underlying business clearly exceeds the liabilities of the business, and receivership is an avenue for creditors to seek a court to force a restructuring or liquidation of a business, even over the objections of the business itself, an ABC process can be appealing where the creditor and debtor maintain relatively amicable relations, but the value of the business is such that it is clear the equity holders have little to no value remaining in the business. A creditor may view the ABC process, which is generally a lower cost option as compared with a court-supervised receivership, as the superior proposition in these circumstances.

An ABC is a state common law or statutory remedy available to debtors that is roughly analogous to a Chapter 7 bankruptcy or liquidating Chapter 11 bankruptcy. Unlike a receivership, where a creditor applies to a court for the appointment of a receiver and such an appointment can be granted even over the objection of the debtor, an ABC is a step taken by the debtor itself to liquidate its assets in an orderly fashion with the proceeds paid to its creditors. While courts can be involved to resolve specific matters, and ABC process is principally undertaken without court involvement or direct supervision.

Unlike a receivership, an ABC is a step taken by the debtor itself to liquidate its assets in an orderly fashion with the proceeds paid to its creditorsTo initiate an ABC process, the debtor selects the assignee to take ownership of its assets and such assignee holds such assets in the functional equivalent of a trust for the benefit of the creditors of the debtor. As such, the assignee, while selected by the debtor, owes duties (typically fiduciary duties under state law) to the body of creditors.

Once the assignment has occurred, the assignee will engage in a relatively significant diligence effort in order to gain a clear understanding of the assets and liabilities of the debtor, to complete the assignment and to provide notice to third parties and creditors of the fact that the assignment has occurred. The assignee then generally oversees the operation of the business (if it is continuing) while moving to create a sale process for its assets, whether through some sort of public auction or a privately negotiated sale (which, as in bankruptcy proceedings, may include stalking horse bids).

One notable difference between the bankruptcy and receivership process and an ABC is that, in general, assets sold in an ABC are not sold free and clear of all underlying liens, meaning that senior secured creditors must consent to any sale, or their liens will travel with the assets.

While ABCs offer many advantages over receiverships, including a typically lower cost, flexibility in the selection of the assignee, and a generally easier and faster path to liquidation of assets, there are limitations, including the risk that a third party may seek to appoint a receiver after an ABC has been commenced or that the compensation package granted the assignee is disproportionately high, each of which could ultimately result in higher costs for all involved. Furthermore, sales of assets in an ABC are not automatically sold free and clear of all liens.

In the end, regardless of where a cannabis company may be operating, the lack of access to federal bankruptcy courts does not deprive the company or its creditors of viable avenues to restructure or liquidate a business. However, because these options are less familiar to those who typically operate in the bankruptcy-centric restructuring arena in other industries, companies and creditors in the cannabis space are well advised to consult with counsel familiar with the cannabis industry and the restructuring alternatives that remain available to them.