With more cannabis staffing and recruiting challenges than ever before, building a healthy pipeline of top candidates can be an uphill battle. From a lack of qualified candidates and working capital to the haze of lingering stigma and industry volatility, cannabis hiring and retention challenges are more apparent than ever.

Understanding the pain points of cannabis staffing and how to flip them in your favor is critical for attracting the talent you need to grow your business.

Emerging Candidate Concerns

Low unemployment coupled with high demand for qualified talent has led to fierce competition among cannabis hiring managers and HR professionals. This means finding candidates with the right skills and industry experience can be exceptionally difficult.

Dispensary and budtender jobs are some of the most popular entry-level cannabis employment opportunities. But since these are customer-facing roles, the requirements to work in a dispensary span a range of skillsets.

Not only do candidates need excellent interpersonal skills, they should also have a deep understanding of the differences and synergies in strains, terpene profiles and cannabinoid contents. The starting hourly pay for these retail dispensary jobs is only about $12-16 per hour. Finding candidates with relevant dispensary experience at such a low rate is not an easy feat.

Then there are the extractors and directors of extraction. While these positions are higher-paying than dispensary jobs, they are more dangerous and require a more specific skillset. Engaging qualified candidates for this high-risk position can take a lot of time and effort. In addition, employers also have to assume liabilities and higher compensation demands.

Other cannabis employment types that staffing departments and agencies have to hire are highly specialized.

Not only do you need talented and knowledgeable salespeople, marketers and accountants, there are also laboratory workers, trimmers, cultivation laborers and supervisors, master growers, dispensary managers and delivery drivers to account for.

Lack of Working Capital

With market demand continuing to rise, having the manpower in place is vital to remain competitive. But hiring costs money. Recruiting, advertising and interviewing requires adequate cannabis funding and/or working capital. Unfortunately, obtaining and securing capital to grow and hire is difficult in the industry today.

Making the wrong hiring decision can be costly. If you break any laws during the recruiting process, you can get hit with a hefty lawsuit. The majority of industry players today are startups with limited financial resources. A lawsuit can mean shutting down shop and going out of business.

The Volatile Nature of the Industry

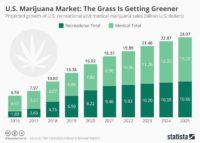

The advancement and adoption of cannabis legislation are rapidly underway for medical use, recreational use and everything in between.

With shifting public sentiments, state-specific cannabis laws and licensing requirements, the industry is in a constant state of change. Even the requirements to work in the cannabis industry vary from state to state.

The ever-rising tide of volatility makes it difficult for companies to find enough stability to make responsible hiring decisions. One regulatory revision can require a company to pivot its branding, product line and entire marketing strategy from top to bottom. A shift in strategy can mean a shift in employee requirements and skillsets. This instability tends to be unappealing to candidates who are accustomed to a well-established workplace structure and culture.

With so much volatility and uncertainty, prioritizing employee relationship management seems like a wise decision. But in-house cannabis human resources is just not in the cards in many cases. Instead, cannabis staffing, recruiting and HR tend to be outsourced along with accounting and compliance.

Lack of Suitable Cannabis Recruiting Platforms

While perceptions are changing, misconceptions about the industry are still pervasive.

Lingering market stigma presents a grave challenge for cannabis staffing and hiring. In fact, many mainstream recruiting platforms are unwilling to partner with cannabis companies. Fortunately, there are some relatively new cannabis HR agencies and platforms to help solve some of the challenges of hiring in cannabis. Vangst GIGS, for example, is the first and only fully-compliant cannabis staffing platform. The CBD staffing agency has been up and running for just a few years now.

Future of Cannabis Staffing and Hiring Demands

While hemp-derived CBD has been legal since the signing of the 2018 U.S. Farm Bill, marijuana-derived CBD is still illegal. But this may change sooner rather than later.

There is growing bipartisan support for the legalization and regulation of cannabis. Beyond improving quality assurance and resolving the disconnect between state and federal laws, federal cannabis legalization will have a profound impact on the U.S. economy.

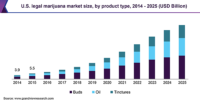

In fact, New Frontier Data projects federal legalization will create $128.8 billion in additional tax revenue and 1.63 million legal cannabis jobs in the U.S. by 2025.

Cannabis payroll deductions could also increase to $9.5 billion by 2025 because more legal entities, customers and employees would be participating in the market.

With federal legislation likely coming in the near future, knowing how to navigate and scale cannabis human resources, including hemp staffing, are more important than ever. You need the right people and processes to take advantage of the market opportunities legalization would create.

Companies that adapt to industry changes will be better at recruiting top talent and mitigating future staffing shortages. Forward-looking companies and fund managers are already obtaining cannabis business loans and ramping up HR preparations and organizational structuring to get a jumpstart on the pace of change.