As a cannabis lawyer, I spend a lot of time thinking about the ways that regulations affect a cannabis company’s bottom line. Since I’m in California, the ways are many.

In late 2017 I became the chief compliance officer for an Oakland startup that carried out delivery, distribution, cultivation and six manufacturing operations. A big part of my job was preparing my company, along with several equity cannabis companies, for California’s First Wave of cannabis licenses.

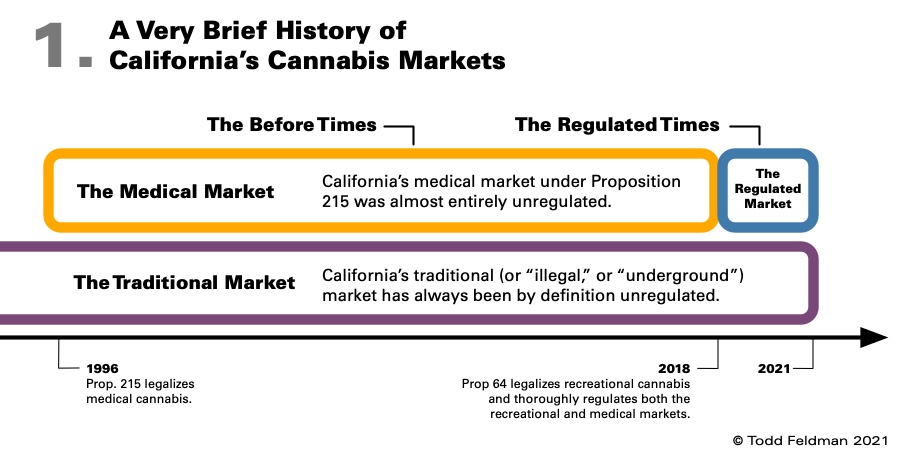

For the most part, First Wave licensees came from California’s essentially unregulated medical cannabis market, and/or from California’s by-definition unregulated “traditional” market. When California began issuing licenses in January 2018, many First Wavers were unprepared because their businesses practices had evolved in an unregulated market. A big part of my job was to help them adapt to the new requirements. As a result, I saw the regulations, and the effects of regulations, in sharp relief.

For the most part, First Wave licensees came from California’s essentially unregulated medical cannabis market, and/or from California’s by-definition unregulated “traditional” market. When California began issuing licenses in January 2018, many First Wavers were unprepared because their businesses practices had evolved in an unregulated market. A big part of my job was to help them adapt to the new requirements. As a result, I saw the regulations, and the effects of regulations, in sharp relief.

Regulation touches virtually every aspect of the legal cannabis industry in California. So anyone who wants to understand the industry should have at least a basic understanding of how the regs work. I’m writing this series to lay that out, in broad strokes.

Some key points:

- The regulated market must be understood in relation to the previous unregulated (medical) market as well as the ongoing traditional market.

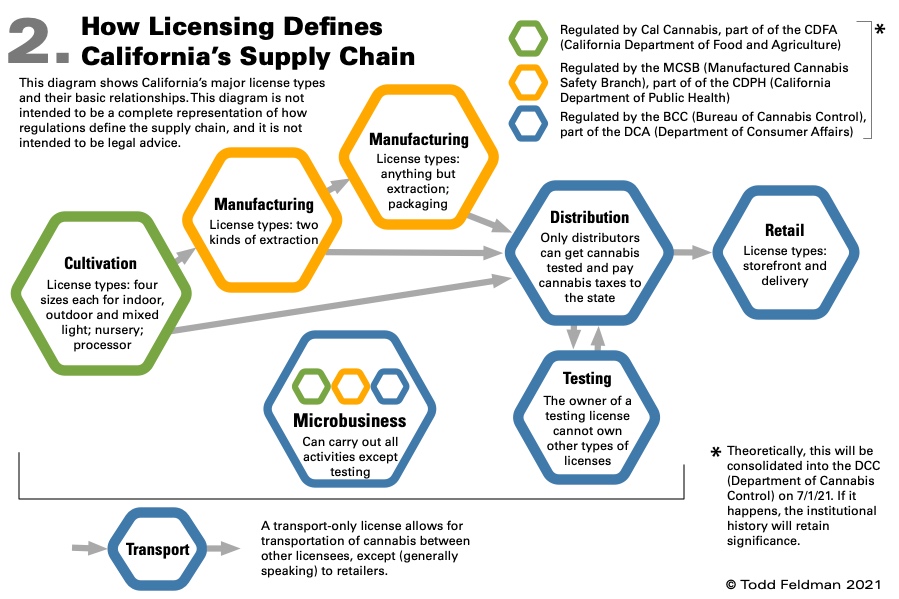

- Regs define the supply chain.

- Regs are designed to ensure product safety and maximize tax revenue.

- Many regulations mandate good business practices.

- Local enforcement of building, health and safety codes tends to be zealous and costly.

A Tale of Three Markets

California’s regulated cannabis market can only be understood in relation to the medical market that preceded it, and in relation to the traditional market (illegal market) that continues to compete with it.

The Before Times

California’s legal medical cannabis market goes back to 1996, when the Compassionate Use Act passed by ballot measure. One fact that shaped the medical market was that it was never just medical – while it served bona fide patients, it also served as a Trojan horse for adult-use (recreational) purchasers.

Another fact that shaped the medical market was a near complete lack of regulation. On the seller’s side, you had to be organized as a collective. On the buyer’s side, you had to have a medical card. That was it.

Meanwhile, the cannabis supply chain was entirely unregulated. This tended to minimize production costs. It also meant that a patient visiting a dispensary had no way of verifying where the products had been made, or how.

The Regulated Times

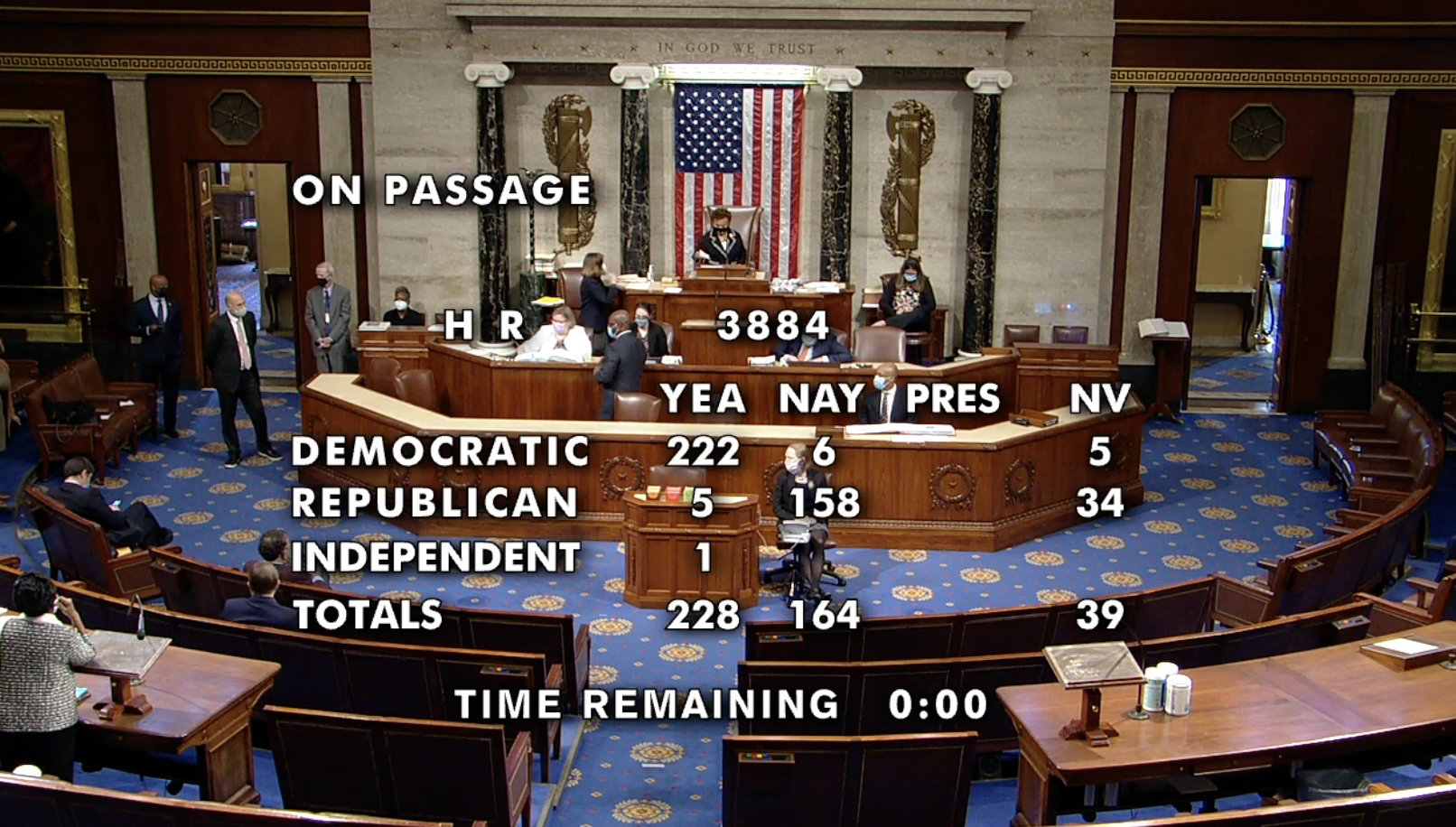

Licensing under the Medical and Adult-Use Cannabis Regulation and Safety Act (the “Act”) began on January 1, 2018. It was the beginning of legal adult-use cannabis in California. It was also the beginning of the Regulated Times, as the Act and accompanying 300-plus pages of regulations transformed the legal cannabis market.

For example:

- The Act defines the cannabis supply chain (as a series of licensees).

- Across the supply chain, the internal procedures of cannabis companies are subject to review by state agencies;

- Cultivators and manufacturers cannot sell directly to a dispensary – they must go through a distributor;

- All cannabis must be tested for potency and a long list of contaminants by a licensed testing laboratory before it may be sold to consumers;

- And beginning in 2019, all licensees were required to participate in the California Cannabis Track and Trace (CCTT) program, which is designed to track all cannabis from seed to sale.

Just as importantly, the Act establishes a dual licensing system – that is to say, in order to operate, a cannabis company needs a local permit (or other authorization) as well as a state license. In fact, local authorization is a prerequisite for a state license. And your local jurisdiction will have its own rules for cannabis that apply in addition to the state rules, up to and including a ban on cannabis activities.

Needless to say, operating in the Regulated Times is a lot more complicated and expensive than it was during the Before Times.

Especially when you consider the taxes. For example, in the City of Los Angeles, sale of adult-use cannabis is taxed at 10%, which means that any adult-use purchase in L.A. gets a 34.5% markup:

Especially when you consider the taxes. For example, in the City of Los Angeles, sale of adult-use cannabis is taxed at 10%, which means that any adult-use purchase in L.A. gets a 34.5% markup:

- 15% state cannabis excise tax, plus

- 10% Los Angeles Adult Use Cannabis Sales tax, plus

- 5% sales tax.

Note that the distributors must collect the excise tax from the retailer, so the 15% markup is not necessarily visible to the consumer. Similarly, consumers are generally unaware that there is a cultivation tax of $9.65 per ounce (or about $1.21 per eighth) of dried flower that the distributor has to collect from the cultivator.

Theoretically, all of this might be unproblematic if licensed retailers were only competing with each other. Which brings us to:

The Traditional Market

The traditional market is the illegal market, which is to say, the untaxed and unregulated market.

Legalization of adult-use cannabis was supposed to destroy the traditional market, but it hasn’t. As of early 2020, the traditional market was estimated to be 80% of the total cannabis market in California. This is not surprising, since the traditional market has the advantages of being untaxed and unregulated.

The traditional market has a pervasive negative effect on the legal market. For example, the traditional market tends to depress prices in the legal market and tends to attract talent away from the legal market. Some of these effects will be discussed in the following articles.

This article is an opinion only and is not intended to be legal advice.