Every detail counts at an indoor grow facility. Indoor growers have complete control over nearly every aspect of their crop, ranging from light intensity to air circulation. Among the most important factors to regulate is temperature. While ambient air temperature is critical, growers will also want to measure leaf surface temperature (LST).

To illustrate, let’s say you keep your living room at a cozy 76 degrees. Then, if you place a thermometer under your tongue – your body is (hopefully) not at 76 degrees but is likely between a healthy temperature of 97 to 99 degrees.

A similar story can be told for cannabis plants grown indoors. A grow facility’s ambient air is often different than the plants’ LST. Finding an ideal LST for plant growth can be complex, but modern technology, including spectrally tunable LED grow lights, can simplify monitoring and maintaining this critical aspect.

Why Should Growers Care About LST?

Temperature plays a pivotal role in plant health. Many biochemical reactions contributing to growth and survival only occur within an ideal temperature range. If temperatures dip or spike dramatically, growers may witness inhibited growth, plant stress or irreversible damage to their crops.

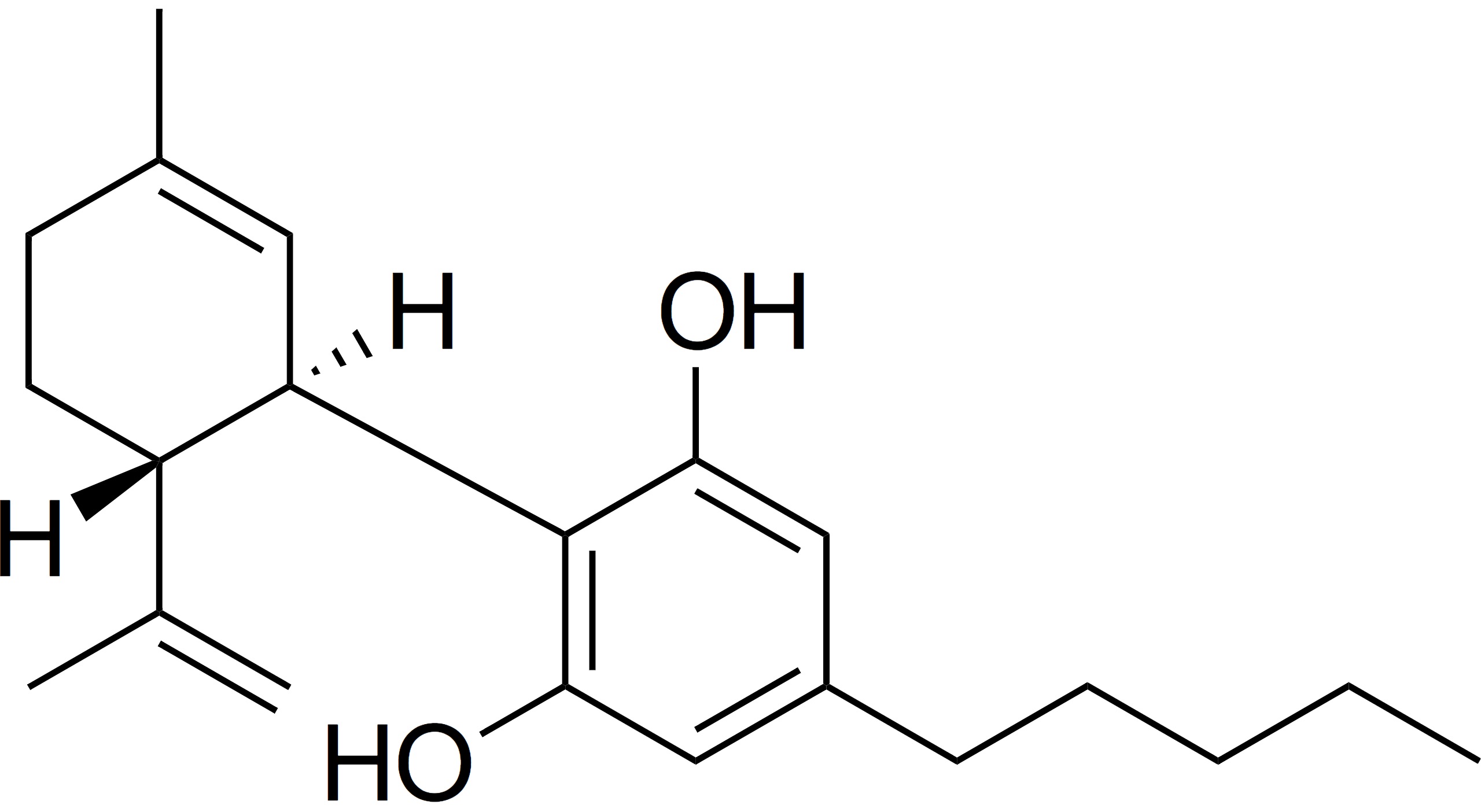

The leaf is among the most important plant structures as it’s where most metabolic processes happen. Therefore, finding an optimum LST can improve growth rate and the production of metabolites such as pigments, terpenes, resins and vitamins.

Because many plants rely on their leaves for survival, it makes sense that leaves have their own temperature regulation system. Evaporation through pores in the leaf – known as stomata – can cool the plant through a process called transpiration. Up to 90% of water absorbed is used for transpiration, while 10% is used for growth.

Because many plants rely on their leaves for survival, it makes sense that leaves have their own temperature regulation system. Evaporation through pores in the leaf – known as stomata – can cool the plant through a process called transpiration. Up to 90% of water absorbed is used for transpiration, while 10% is used for growth.

The efficacy of transpiration is determined by the vapor pressure deficit (VPD), which refers to the relative humidity in the ambient air compared to the relative humidity in the leaf. If relative humidity is low, the VPD can be too high, which may cause plants to have withered, leathery leaves and stunted growth. On the other hand, a low VPD correlates to high relative humidity, and can quickly result in disease and mineral deficiencies. Higher humidity often results in a higher LST as transpiration may not be as effective.

When it comes to LST, growers should follow these basic guidelines:

- Most cannabis plants’ LST should fall between 72 and 86 degrees – generally warmer than the ambient air.

- LST varies depending on individual cultivar. For example, plants that have evolved in colder climates can generally tolerate cooler temperatures. The same can be said for those evolved in equatorial or temperate climates.

- CO2 availability also plays a role in LST; CO2 generally raises the target temperature for photosynthesis.

How Does Light Spectrum Affect LST?

We know that CO2 concentration, specific genetic markers and ambient temperature all play an important role in moderating LST. But another important factor at an indoor grow is light spectrum – especially for those using spectrally tunable LEDs. Growers will want to optimize their light spectrum to provide their crop with ideal conditions.

A combination of red and blue wavelengths is shown to have the greatest impact on photosynthesis and, thus, LST. Photons found along the green and yellow wavelengths may not be absorbed as efficiently and instead create heat.

Optimized light spectrums – those with an appropriate balance between red and blue light – create more chemical energy instead of heat, thereby resulting in a lower LST. Using fixtures that are not spectrally tuned for plant growth, on the other hand, can waste energy and ultimately contribute to a higher LST and ambient temperature, negatively affecting plant growth. Consequently, measuring LST doesn’t only indicate ideal growing conditions but also indirectly illustrates the efficiency of your grow lights.

LED fixtures already run at a lower temperature than other lighting technologies, so indoor growers may need to raise the ambient temperature at their grow facilities to maintain ideal LST. Switching to spectrally tuned LEDs may help growers cut down on cooling and dehumidifying costs, while simultaneously improving crop health and productivity.

What’s the Best Way to Measure LST?

There are several tools available for growers to measure LST, ranging from advanced probes to specialty cameras. However, many of these tools provide a reading at a specific point, rather than the whole leaf, leading to some inaccuracies. Temperature can dramatically vary across the leaf, depending if parts are fully exposed to the light or in the shadows.

Investing in a forward-looking infrared camera (FLIR) gives indoor growers a more accurate picture of LST and light efficiency. That being said, growers should not only measure leaves at the top of the plant, but across the middle and bottom of the plant as well. That way, growers receive a complete snapshot of growing conditions and can make changes as needed.

At an indoor grow facility, it’s not enough to only measure ambient room temperature. Of course, this aspect is important, but it will paint an incomplete picture of plant health. Measuring LST gives growers nuanced insights as to how plants respond to their environment and how they can better encourage resilient, healthy growth.

Using spectrally tunable LEDs makes achieving LST easier and more cost-effective. Lights with optimized spectrums for plant growth ensure no energy is wasted – resulting in superior performance and efficiency.