Ask any cannabis connoisseur, and they’ll likely tell you that cannabis delivery services have been around for a long, long time. Given the distancing requirements of the COVID years, the increasing number of medical cannabis patients who need or would like cannabis delivered to their door and the surge in recreational adult use sales, cannabis delivery is coming out of the shadows and into the legal cannabis industry.

Proponents of cannabis delivery say that creating a legal structure and guidelines that allow cannabis home delivery encourages people to buy from legal sources rather than the legacy market. In some cases, it’s a way to entice legacy cannabis delivery operators to transition to the licensed and regulated market. While many states remain hesitant to allow adult use cannabis delivery, some do, and others have taken the first step, allowing delivery to registered medical cannabis patients and caregivers.

Where is Cannabis Delivery Legal?

According to Cannabis Business Times, states that permit medical cannabis delivery as part of another license type, retail, for example, or with a specific delivery license include: Arizona, Arkansas, California, Colorado, Maine, Maryland, Massachusetts, Michigan, Nevada, New Mexico, New York, Oregon, Rhode Island and Vermont. Complex reports that delivery service is legally available without any restrictions to anyone 21 years or older in California, Nevada and Oregon.

Medical or adult use, there are restrictions on where cannabis can be delivered, even within states that allow it. For instance, you can’t legally deliver cannabis to college or university campuses. Although many people still discreetly deliver and receive cannabis products on campuses, it’s illegal to do so since cannabis is a federally controlled substance and higher education institutions that receive federal funding must prohibit its use and distribution.

Medical or adult use, there are restrictions on where cannabis can be delivered, even within states that allow it. For instance, you can’t legally deliver cannabis to college or university campuses. Although many people still discreetly deliver and receive cannabis products on campuses, it’s illegal to do so since cannabis is a federally controlled substance and higher education institutions that receive federal funding must prohibit its use and distribution.

It’s noteworthy that some states without legal cannabis delivery regulations have a “loophole” through which some delivery businesses operate. Gifting, for example, is an established, though not entirely legal, delivery practice. According to NJ.com, New Jersey falls into the gifting loophole category:

Licenses to sell legal weed are still months away, but there’s a handful of entrepreneurs coming into the scene through a possible legal loophole — “gifting” cannabis. It’s a scheme popular in other states and particularly in Washington, D.C. A company lets you buy cookies, snacks or brownies that come with sticker shock of $50 or more. But when they make the delivery, it comes with a suggested gift: maybe a cannabis edible or an ounce of flower.

Although many underground businesses thrive in the Garden State’s “in-between” market, NJ.com also reports that gray market operators have faced legal penalties and even jail time.

Why Are Cannabis Delivery Services Popular?

Cannabis delivery services have a rich cultural history in the underground market. Rather than making a transaction in public, home delivery provides a more intimate and secure way of selling cannabis to consumers.

Cannabis delivery has skyrocketed in popularity due to the COVID-19 crisis. MJBizDaily reports that online cannabis orders boomed during the pandemic, increasing the need for cannabis delivery services.

Cannabis delivery has skyrocketed in popularity due to the COVID-19 crisis. MJBizDaily reports that online cannabis orders boomed during the pandemic, increasing the need for cannabis delivery services.

Historically, cannabis delivery services also help registered medical cannabis patients receive access to their medicine since their disability or chronic condition might prevent them from leaving the house and visiting a dispensary. This can be especially true for seniors, even if they aren’t a registered patient, but live in a state with adult use cannabis.

What’s the Difference Between Cannabis Delivery and Transport Licenses?

There is real confusion surrounding the differences between delivery and transport licenses. Basically, delivery licenses are B2C (business to consumer), and transport licenses are B2B (business to business).

Cannabis delivery and courier licenses allow licensees to deliver cannabis products directly to patients, caregivers, and in some states, consumers. While the name of the license differs depending on the state in which you seek to operate, delivery licenses tend to allow operators to act as a retailer without a traditional bricks and mortar location. Delivery licensees purchase and store wholesale cannabis products and sell them via the delivery model. Couriers, however, are traditionally hired by retailers as their delivery arm. In this model, the retailer takes the order, and the courier delivers, like Door Dash or Uber Eats. One key difference between a delivery and courier license is the significantly lower cost of entry for couriers as they don’t have facility, inventory, or storage costs, and generally have lower operational expenses.

But what about transport licensees? Rather than delivering to individuals, transport licensees typically deliver cannabis products between licensed cannabis facilities, such as a cultivator or manufacturer to a retail dispensary or testing facility.

But what about transport licensees? Rather than delivering to individuals, transport licensees typically deliver cannabis products between licensed cannabis facilities, such as a cultivator or manufacturer to a retail dispensary or testing facility.

In Massachusetts, there are three delivery and transport licenses (courier, delivery operator, and transporter) as well as a delivery endorsement that allows certain licensees to deliver directly from a licensed establishment to consumers.

The first step to operate a cannabis delivery or transport business is determining whether you want to deliver for retail establishments, buy product and deliver directly or transport cannabis between licensed cannabis businesses. Each model has its plusses and minuses, just depends on what you want. It’s important to note that Massachusetts delivery operator licenses are currently reserved for social equity participants, as reported in the Milford Daily News:

“The new “marijuana delivery operator” licenses…will be available exclusively to participants in the CCC’s social equity program and economic empowerment applicants for the first three years.”

Once you decide which type of license you want, the next steps are first to familiarize yourself with your state’s cannabis rules and regulations, and then to complete and submit a license application.

How to Apply for a Cannabis Delivery or Transport License

While the delivery and transport license application process looks different in each state that allows them, all states require applicants to be 21 years of age or older and most require operators to be current residents of the state where they intend to operate. There are also required, non-refundable application and licensing fees. While these fees are not insignificant, the good news is that they tend to be lower than the fees required for other cannabis business license applications.

Since compliance with state rules and regulations is a condition of licensure, licenses are awarded to some or all applicants that meet the application and regulatory requirements. Once awarded, cannabis delivery and transport licensees must maintain compliance or risk hefty fines and/or face a temporary or permanent shut down. One regulatory example is that delivery operators must digitally verify any and every customer’s photo ID before and when a cannabis product is delivered to a recipient; missing this critical step can put your businesses at serious risk of legal and financial consequences.

How to Maintain Compliance Once You’re Licensed

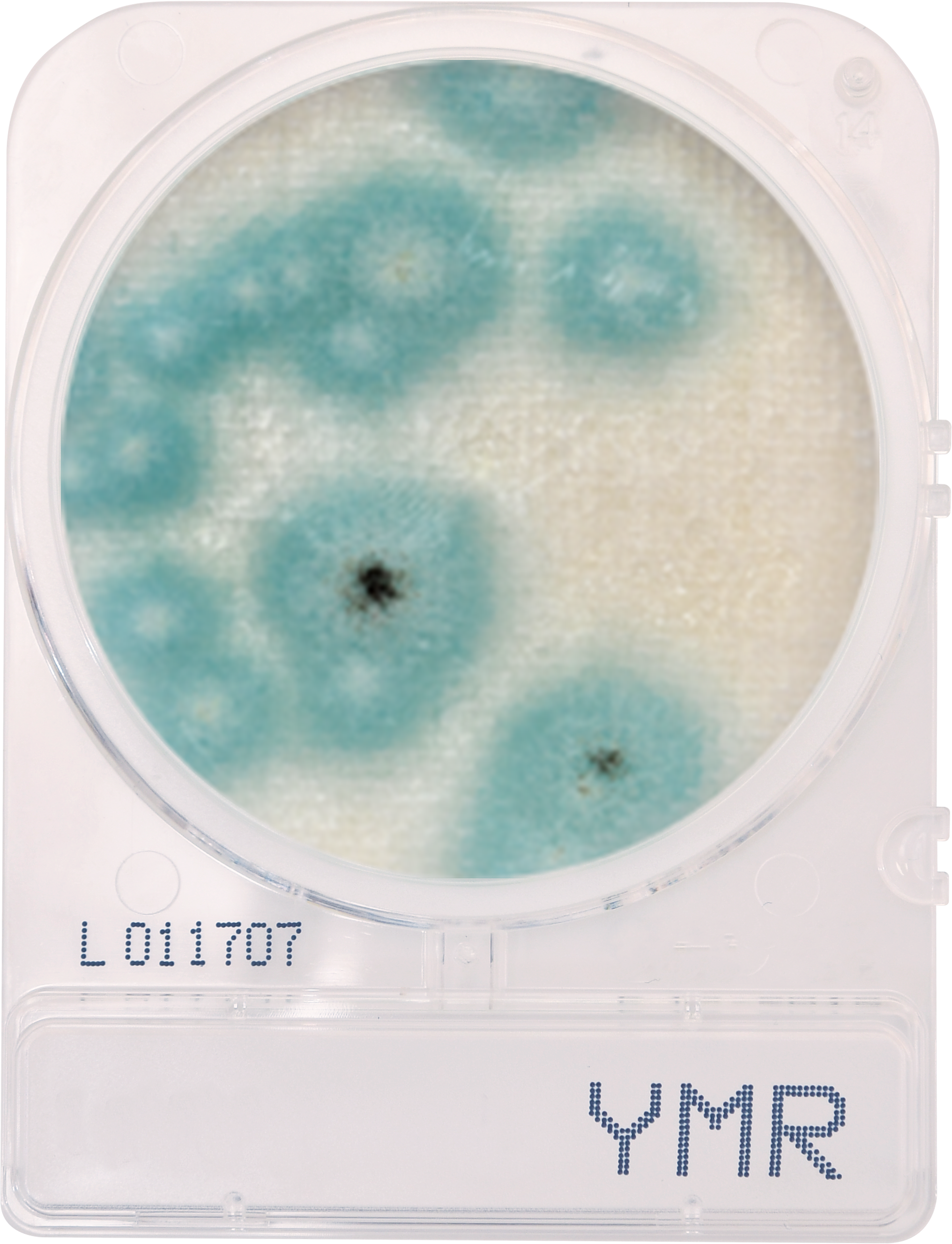

Maintaining compliance for any cannabis business can be challenging. There are strict guidelines on marketing and advertising, security, employee training, inventory management and more. Additionally, there are restrictions specific to cannabis delivery services, particularly limits on how much product can be delivered per order/transaction.

What does cannabis compliance specifically look like for cannabis delivery licensees? For one, all merchants must verify ID before an order is fulfilled. In states with medical cannabis, this would require medical card ID verification. Otherwise, for adult use markets, a driver’s license or other state-issued photo ID with a valid birthdate is acceptable. Some states require recipients to sign a manifest or receipt acknowledging that they accepted the cannabis order and for the licensee to maintain a record of that acknowledgement for a specified number of years.

There are many other regulations that delivery operators must adhere to and many ways to stay up to date and compliant. Tasking a staff member to handle all things compliance is one option. Another is hiring a compliance professional to set up and oversee a compliance operating system and/or partnering with a compliance software solution provider.

Cannabis delivery services can be very profitable. In comparison to other cannabis licenses, they don’t require as much finance capital to get started. Once a license is obtained, your priority will turn to maintaining compliance. Too many delivery services exist in a precariously legal gray area; don’t let yours be one of them.

As Brown noted, the CRC also thinks they need to make sure there is adequate supply before the state opens the market. However, businesses appear to be ready and chomping at the bit to get started with the adult use program. Patrik Jonsson, regional president of the northeast for Curaleaf says they have been ready. “Give us 48 hours, and we can pretty much do whatever the state wants, and we’ll open,” says Jonsson. “We have product, the people and the facilities. There are a few minor things we need clarified around the product. But we are very much ready for turning it on as soon as the state lets us.” Curaleaf is the biggest cannabis company in New Jersey and has two cultivation facilities and three retail locations across the state.

As Brown noted, the CRC also thinks they need to make sure there is adequate supply before the state opens the market. However, businesses appear to be ready and chomping at the bit to get started with the adult use program. Patrik Jonsson, regional president of the northeast for Curaleaf says they have been ready. “Give us 48 hours, and we can pretty much do whatever the state wants, and we’ll open,” says Jonsson. “We have product, the people and the facilities. There are a few minor things we need clarified around the product. But we are very much ready for turning it on as soon as the state lets us.” Curaleaf is the biggest cannabis company in New Jersey and has two cultivation facilities and three retail locations across the state.