As a strange year heads to a final, painful finish, there have been some major (and some less so) changes afoot in the global world of cannabis regulation. These developments have also undoubtedly been influenced by recent events, such as the recent elections in the United States, state votes for adult use reform in the U.S. and the overall global temperature towards reform. And while all are broadly positive, they have not actually accomplished very much altogether.

Here is a brief overview of the same.

The UN Vote On Cannabis

Despite a wide celebration in the cannabis press, along with proclamations of an unprecedented victory by large Canadian companies who are more interested in keeping their stock prices high than anything else, the December 2 vote on cannabis was actually fairly indecisive.

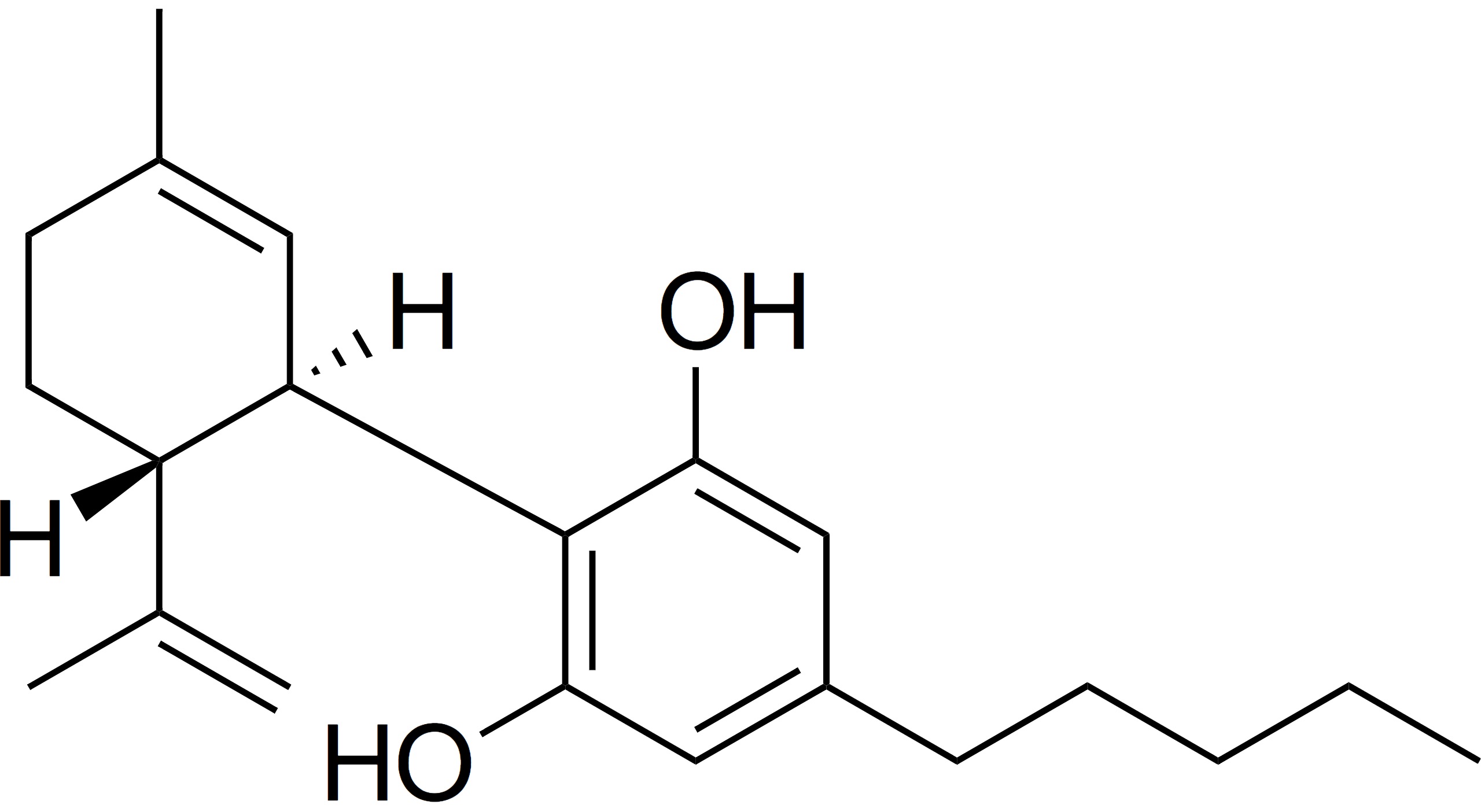

Following the WHO recommendations to reschedule cannabis, the UN voted in favor of the symbolic move. Despite removing cannabinoids from Schedule IV globally, a regulatory label designed for highly addictive, prescription drugs (like Valium), the actual results on the ground for the average company and patient will be inconclusive.

Following the WHO recommendations to reschedule cannabis, the UN voted in favor of the symbolic move. Despite removing cannabinoids from Schedule IV globally, a regulatory label designed for highly addictive, prescription drugs (like Valium), the actual results on the ground for the average company and patient will be inconclusive.

The first issue is that the UN did not remove cannabinoids themselves, or the plant, from Schedule I designation. This essentially means that countries and regions will be on the front lines to create more local, sovereign policies. This is not likely to change for at least the next several years (more likely decade) as the globe comes to terms with not just a reality post-COVID-19, but one which is very much pro-cannabis.

In the meantime, however, the ruling will make it easier for research to be conducted, for patient access (for the long term), and more difficult for insurers to turn down in jurisdictions where the supposed “danger” of cannabis has been used as an excuse to deny coverage. See Germany as a perfect example of the same.

It is also a boon for the CBD business, no matter where it is. Between this decision and the recent victory in Europe about whether CBD is a narcotic or not (see below), this is another nail in the coffin for those who want to use semantic excuses to restrain the obvious global desire for cannabinoids, with or without THC.

The U.S. Vote On The MORE Act

While undoubtedly a “victory” in the overall cannabis debate, the MORE Act actually means less rather than more. It will not become law as the Senate version of the bill is unlikely to even get to the floor of the chamber before the end of the session – which ends at the end of this year.

That said, the vote is significant in that it is a test of the current trends and views towards big issues within the overall discussion, beginning with decriminalization and a reform of current criminal and social justice issues inherent in the same. The Biden Administration, while plagued with a multitude of issues, beginning with the pandemic and its immediate aftershocks, will not be able to push both off the radar. Given the intersection of minority rights’ issues, the growing legality of the drug and acceptance thereof, as well as the growing non-partisan position on cannabis use of both the medical and adult use kind, and the economy, expect issues like banking to also have a hope of reform in the next several years.

Cannabis may be taking a back seat to COVID, in other words, but as the legalization of the industry is bound up, inextricably, in economic issues now front and center for every economy, it will be in the headlines a great deal. This makes it an unavoidable issue for the majority of the next four years and on a federal level.

Prognosis in other words? It’s a good next federal step that is safe, but far from enough.

The European Commission (EC) Has Finally Seen The Light On CBD

One of the most immediately positive and impactful decisions of the last month was absolutely the EC decision on whether CBD is a narcotic or not.

This combined with the UN rescheduling, will actually be the huge boost the CBD industry has been waiting for here, with one big and still major overhanging caveat – namely whether the plant is a “novel” one or not. It is unlikely as the situation continues to cook, that Cannabis Sativa L, when it hits a court of law, will ever be actually found as such. It has inhabited the region and been used by its residents for thousands of years.

This combined with the UN rescheduling, will actually be the huge boost the CBD industry has been waiting for here, with one big and still major overhanging caveat – namely whether the plant is a “novel” one or not. It is unlikely as the situation continues to cook, that Cannabis Sativa L, when it hits a court of law, will ever be actually found as such. It has inhabited the region and been used by its residents for thousands of years.

However, beyond this, important regulatory guidance will need to fall somewhere on the matter of processing and extraction. It is in fact in the processing and extraction part of the debate that this discussion about Novel Food actually means something, beyond the political jockeying and hay made so far.

Beyond this of course, the marketing of CBD now allowed by this decision, will absolutely move the topic of cannabinoids front and center in the overall public sphere. That linked with sovereign experiments on adult use markets of the THC kind (see Holland, Luxembourg and Denmark as well as Portugal and Spain right after that), is far from a null sum game.

Legal Challenges Of Note

Against this changing regulatory schemata, court cases and legal decisions remain very important as they also add flavor to how regulations are interpreted and followed. The most important court case in Europe right now is the one now waiting to be decided in the Court of Human Rights at Strasbourg regarding the human rights implications of accessing the plant.

Beyond that, in Germany, recent case law at a regional social benefits court (LSG) has begun to establish that the cannabis discussion is ultimately between doctors and their patients. While this still does not solve the problem of doctor reluctance to prescribe the drug, barriers are indeed coming down thanks to legal challenges.

Bottom line, the industry has been handed a nice whiff of confidence, but there is a still high and thorny bramble remaining to get through – and it will not happen overnight, or indeed even over the next several years.